Author: Tyler Durden

Source

Remember when Janet Yellen exclaimed proudly that there would never be another financial crisis “in our lifetimes” in 2017, only to see the repo crisis and the reaction to COVID lockdown policies prompt the biggest response by The Fed ever.

Well, we hate to say it but she may have just ‘cursed’ something even more ominous this time, saying, when asked for comment about the increase in non-dollar trade around the world since US sanctions began:

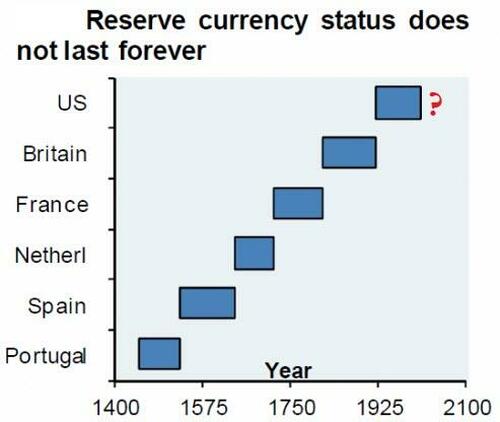

“I don’t think the dollar has any serious competition, and is not likely to for a long time.”

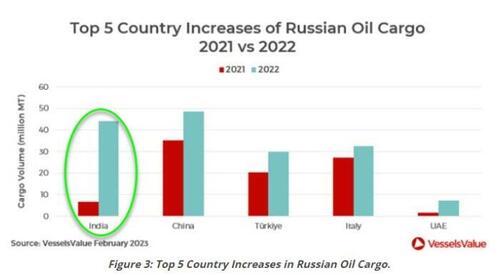

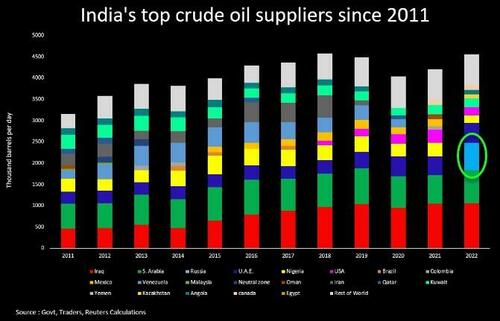

The reason the question of the dollar’s ongoing dominance is growing louder is simple – as Reuters reports, US-led international sanctions on Russia have begun to erode the dollar’s decades-old dominance of international oil trade as most deals with India – Russia’s top outlet for seaborne crude – have been settled in other currencies.

India is the world’s number three importer of oil and Russia became its leading supplier after Europe shunned Moscow’s supplies following its invasion of Ukraine begun in February last year.

As Reuters notes, after a coalition opposed to the war imposed an oil price cap on Russia on Dec. 5, Indian customers have paid for most Russian oil in non-dollar currencies, including the United Arab Emirates dirham and more recently the Russian rouble, multiple oil trading and banking sources said.

Most notably, the transactions in the last three months total the equivalent of several hundred million dollars, the sources added, in a shift that has not previously been reported.

As a reminder, IMF Deputy Managing Director Gita Gopinath said in the month after Russia’s invasion of Ukraine that sanctions on Russia could erode the dollar’s dominance by encouraging smaller trading blocs using other currencies.

“The dollar would remain the major global currency even in that landscape but fragmentation at a smaller level is certainly quite possible,” she told the Financial Times.

Additionally, beyond Russia, tensions between China and the West are also eroding the long-established norms of dollar-dominated global trade.

Will Yellen prove right… or will the curse hit?

Remember, as we have pointed out in the past, nothing lasts forever.

Tyler Durden

Fri, 03/10/2023 – 05:45