Union Pacific Corporation (UNP), through its subsidiary, Union Pacific Railroad Company, operates railroads in the United States. Union Pacific Corporation is a

, which has raised dividends for 16 years in a row.

The most recent dividend increase was in May 2022, when the Board of Directors approved a 10.17% increase in the quarterly dividend to $1.30/share.

The company’s peers include CSX Corporation (CSX),

Norfolk Southern Corporation (NSC), and Burlington Northern Santa Fe which is part of Berkshire Hathaway (BRK/B).

Over the past decade this dividend growth stock has delivered an annualized total return of 14.94% to its shareholders. Future returns will likely be much lower, and will be dependent on growth in earnings and starting dividend yields obtained by shareholders. Investors should also not forget that the transportation sector is exposed to the cyclical nature of the economy, and would follow its short-term cycles pretty well.

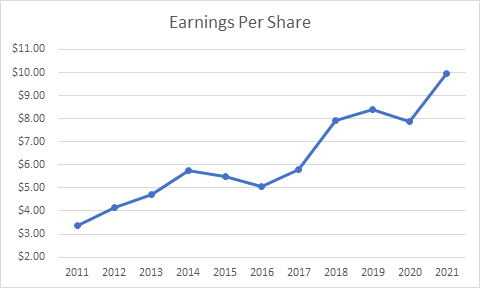

The company has managed to deliver a 11.40% average increase in annual EPS over the past decade. Union Pacific is expected to earn $11.11 per share in 2022 and $12.74 per share in 2023. In comparison, the company earned $9.95/share in 2014.

Railroads are an oligopoly in the US, as 90% of revenues are generated by BNSF, Union Pacific, Norfolk Southern and CSX. The first two operate largely on the west coast, while the last two operate largely on the east coast. Railroads compete for customers, but also share assets as well. They compete with trucks, pipelines, ships and aircraft for hauling goods. Trucking provides more flexibility in transporting goods, though they are more expensive. It makes sense to transport goods on long distances using a combination of rail and other modes of transport for maximum cost savings when moving goods.

Long-term growth will be driven by the growth in US economic activity. When economic activity improves over time, this would translate into more goods being shipped in the country.

The railroad’s best prospects are long-term. As Warren Buffett put it, an investment in railroads is an all-in wager on the economic future of the United States. Over time, the movement of goods in the United States will increase, and railroads like BNSF or Union Pacific should get its full share of the gain. Railroads move goods across longer distances in a much more efficient way that long-haul trucks. This provides railroads a cost advantage.

Today, the United States has half the usable track it had in 1970, though companies like BNSF and Union Pacific are hauling much more freight than they did back then, and the American Association of Railroads estimates that freight loads will nearly double by 2035. That congestion, which is a signal of demand, means opportunity for railroads to improve existing tracks and add new ones, and boost sales.

The economic moats around railroads are the billions of dollars it costs to build them and the fact that the rights of way they need are all but impossible to obtain today. Therefore, it is unlikely that a new railroad will be created, though other modes of transportation could chip away market share. However, given the fact that it costs 3 – 4 times lower to transport goods through a railroad than truck, railways have inherent cost advantage. This cost advantage could also allow railroads to raise prices, and still remain competitive. Railroads have some geographic advantage as well.

Furthermore, rail companies can increase profits by improving productivity. For example, using smart systems to optimize speed depending on terrain could generate significant fuel savings over time. Reducing the amount of time railcars sit idle, could also improve profitability (since using those assets more effectively reduces the need to buy too many railcars to begin with). Raising the length of trains could further boost productivity.

Most of its employees (85%) are unionized, which could create short-term disruptions from time to time, as contracts are renegotiated.

Union Pacific operates the longest network of railroad track in the US, with over 32,000 miles. Freight revenues are derived by three segments:

Bulk – 33% of revenues. Segment includes transporting grain and grain products, fertilizer, food and coal renewables.

Industrial – 36% of revenues. Segment includes Industrial chemicals & plastics, metals & minerals, Forest products, energy & specialized markets.

Premium – 31% of revenues. Segment includes Automotive and Intermodal.

The annual dividend payment has increased by 16.10% per year over the past decade, which is higher than the growth in EPS. Future rates of growth in dividends will be limited to the rate of growth in earnings per share.

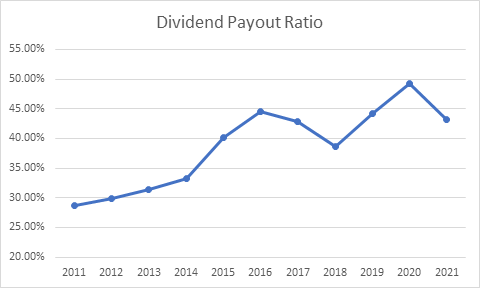

A 16% growth in distributions translates into the dividend payment doubling almost every four and a half years on average. If we check the dividend history, going as far back as 1998, we could see that Union Pacific has managed to double dividends almost every five years on average. The item to add however was that in 1998 the company did cut its dividends by more than 50%, and kept them unchanged until 2002. Therefore, while the dividend is likely sustainable, this is a cyclical company which is more likely to cut distributions than your typical consumer staples or healthcare dividend stock.

In the past decade, the dividend payout ratio has increased from 29% in 2011 to 43% in 2021. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.