Author:

Go to Source

The Harvard

Business Review Entrepreneur's Handbook: Everything You Need to Launch

and Grow Your New Business

Free $0.00 Amazon

A few years ago, when a startup raised a Series A or Series B, founders would bolster the round with venture debt: a term loan and/or a revolving credit line. However, equity dollars are replacing those debt dollars in the last 18 months in the early stage.

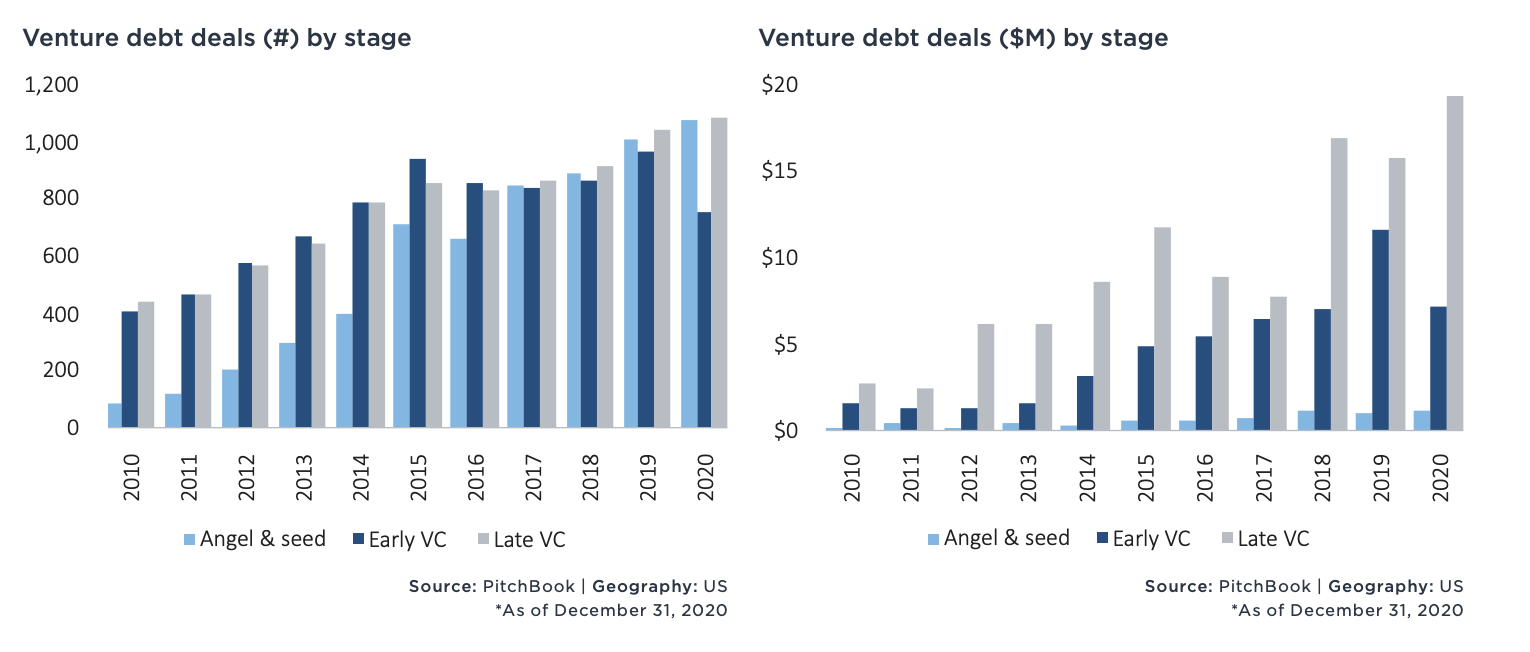

Meanwhile, venture debt dollars have migrated to later stages. Early stage debt origination and round counts peaked in 2019, while later stage debt has increased quite nearly every year. In the later stages, debt is often used to finance acquisitions, and perhaps this is occurring more for venture backed companies.

Why has venture debt shifted later?

The cost of capital in the early stage has fallen dramatically in the last six months, i.e., valuations in the early stage have close to doubled. With an increase in valuation, there’s a concomitant increase in round size. Startups that used to raise $8m on $40m might raise $15m at $80m. The round size is twice the size and the equity dilution is less (20% vs 18.8%).

Flush with cash, why raise debt at the early stage? Though salaries and other costs have increased significantly during this period, round size inflation outstrips these costs, so one should expect startup balance sheets to be relatively stronger than the same business a year ago.

In addition, startups raise bigger rounds earlier in their lifecycles, which may be more challenging for venture lenders to underwrite.

Last, there are new financing options for factoring receivables for startups. Other startups advance cash on SaaS contracts or ad spend, which are alternatives & competitors to venture debt.

Given the amount of capital available at the early stages, founder preferences for financial products is changing, and this is yet another example.

Data credit: Pitchbook