Author: Kyith

Go to Source

Every year, this time of the year, I would share with everyone my spending.

This year, we will be carrying on the tradition as well.

Spending is a way we allocate our resources. We have certain leeway on what we decide to spend on. Some are wiser spenders than others. If you speak with some, they have an issue controlling their spending.

Is tracking your spending (like me) important? Tracking your spending feels like a lot of work, but here is something to think about.

We have enough prospects who came in, tell us their income and expenses, and were shocked that their expenses add up to such a huge amount.

The number came as a shock because there are some things that, if you don’t put the number on a piece of paper, you might not realize they add up to such an amount.

Tracking spending is not OCD behaviour. It gives you a certain level of financial clarity. If you gain insight on how your general spending amount is, you could always stop.

Now let us talk about my 2020 expenses.

How much did Kyith’s family spend in the past few years?

I wrote about how much I spent every year for the past 6 years.

If you are interested in how the spending evolves, you can read them here:

- 2014: $23,798/yr – A review of my past year’s expenses

- 2015: $22,150/yr – How our family’s $22,150 annual expenses mean for our financial security and financial independence

- 2016: $26,238/yr – My Annual Expense Report – $26,238/yr and its link to Financial Security and Independence

- 2017: $21,723/yr – Annual Expense Report 2017 – $21,723

- 2018: $19,655/yr – Annual Expenses and Financial Security Musings

- 2019: $23,186/yr – Spending Report for the Year

- 2020: $22,464/yr – How I spent $22,464 in 2020

In the first 3.5 years, the expenses were made up of spending for 3 adults. For the next 4.5 years (including this year), the expenses were spent for 2 adults.

Review of My Family’s 2021 Expenses

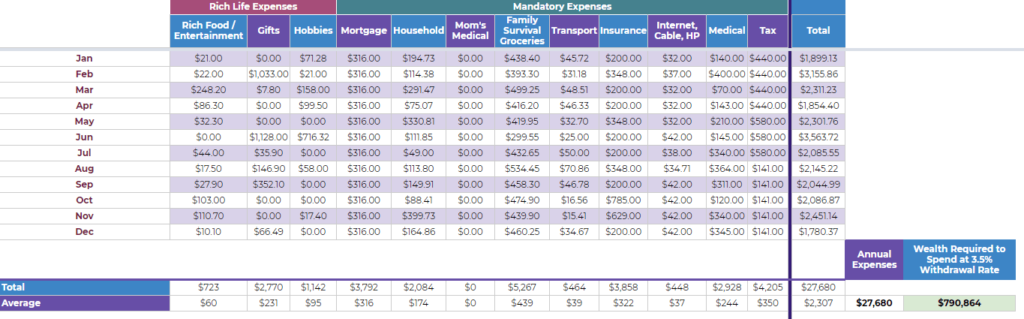

The following table shows a breakdown of my spending in 2021:

The annual expenses come up to $27,680.

This year is the highest spending year since tracking and highest since the number of people fell to two.

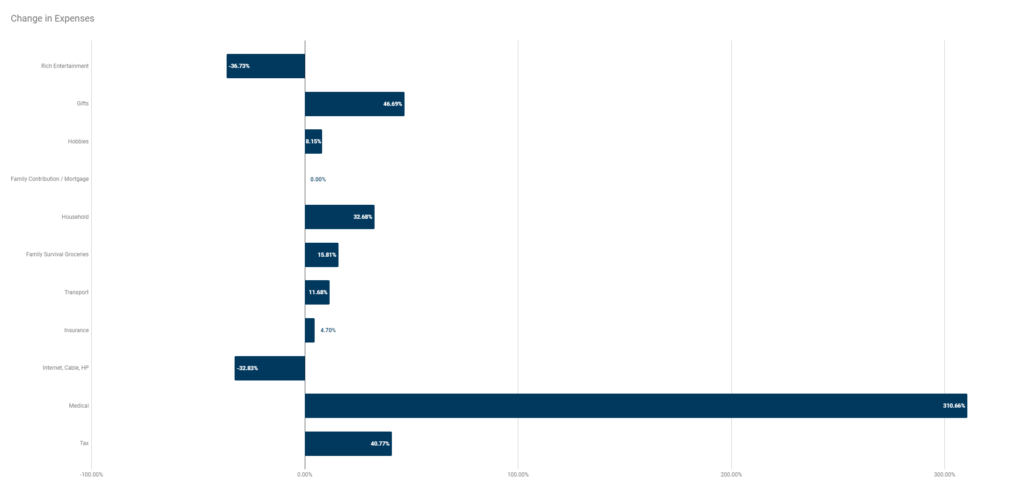

You may be able to see the difference between this year and last year with the following illustration:

The biggest difference from this chat is for medical, taxes, gifts and household.

I started going to see some therapy for my skin upon the recommendation from a colleague. So that bump up the expenses after not spending for so long.

Taxes go up due to blog income and work income.

This year there is more giving one for a friend who helped me with an article that I wrote here and another because… let’s just that I want her to spend her time in Singapore as much as possible without so many monetary considerations.

As we are in constant lockdown, there was less entertainment so that side of the spending was cut down by a fair bit.

On an absolute basis, the groceries bill really went up! Groceries is a set of essential expenses and usually do not vary much.

So it feels like there is almost 20% inflation in one year for an essential expense. This has to be normalized if not, I think not many income streams can sustain this kind of spending.

This probably debunks that idea of inflation going up 3% a year every year. Sometimes we get a year where the spending ramps up 10%.

Would your income stream be able to sustain?

What if you only want to spend on dividends and do not wish to touch your capital? Would your income stream be able to take it? If not what would you do?

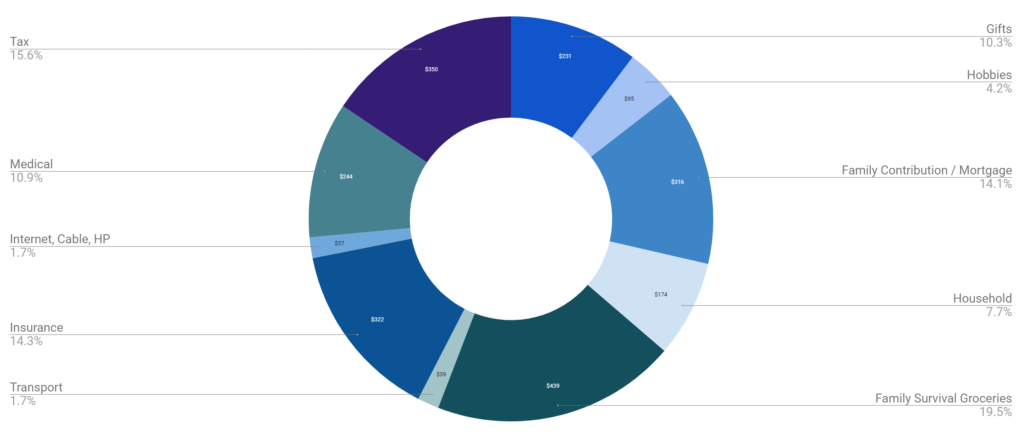

Here is a different view, which shows the monthly expenses in a pie chart:

The Relationship Between Your Spending and Financial Independence Goals

Tracking your spending is not budgeting.

Tracking your spending allows you to review how you had spent your money but if you do not make deliberate modifications, then things would continue on their current path.

However, if you tabulate up some of these spending reports, you would be able to make out the nature of your spending and understand which of your expenses are more essential, which are discretionary, how much is variable and how much is fixed.

One misconception that a lot of people have about their expenses is to segregate each line item into which are variable and fixed, which is essential and which are discretionary.

For each expense, you should be able to split them into a more essential and fixed portion and another which is discretionary and variable.

You cannot say that all your food is essential because some of your food is discretionary. Entertainment is essential to maintain a satisfactory life so you cannot classify entertainment is solely discretionary.

Your expenses allow you to better estimate whether the income you are planning for is going to be enough or not enough.

This should motivate those who felt that tracking this stuff is not too necessary.

Every year, I would use what I spent and estimate a couple of income requirements.

The first is for financial security. This is to estimate how much money to reserve to have a stream of income to pay for expenses to give financial security.

The second is for financial independence. How much money to reserve aside so that there is a stream of income to pay for expenses to stop working.

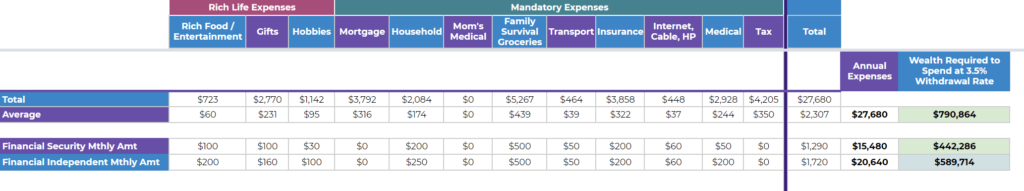

Here is my estimation of my income requirement for both financial security and independence:

In both cases, I did not factor in taxes, and mortgage, and my cash-value life insurance.

Instead of a recurring mortgage, I have set aside a lump sum to pay off the mortgage if I get retrenched or when I stop work.

My estimation of the income for financial security increases from $14,280 to $15,480. My estimation for financial independence increases from $19,440 to $20,640.

For both goals, the amount did not increase by a lot.

My income requirement can be viewed as fixed and essential. Unlike others, there is not much buffer for the income requirement.

So when planning for how much I need to provide this income, I would be more conservative.

You would realize its often a tradeoff this way:

- An income requirement with greater buffers but a less conservative investment income strategy.

- An income requirement with no buffers but a more conservative investment income strategy.

Of course, you can have an income requirement with greater buffers and conservative. You would just need a lot more money. If your plan is an income requirement with no buffers and is less conservative, then you are asking for trouble.

To estimate how much money that I have to set aside for both goals and figure whether I have achieved them, I will use a 3.5% initial withdrawal rate. 3.5% is more conservative and it factors more pessimistic 40-year market and inflation return scenarios. The money should last for 40 years.

However, beyond that, the money might not last as long.

I find that this is a good parameter to benchmark against to figure out how much I need to set aside. (You could use a 2.8% initial withdrawal rate if you want to plan for a 60 year or more perpetual stream of inflation-adjusted income instead)

The amount needed comes up to $442k and $589k respectively. These figures are about $34k more than the previous year. (If you use a 2.8% initial withdrawal rate then it is $553k and $737k which is $111-$148k more to make your plan more secured)

If you feel that you need more line items, a greater amount for some line items, or a buffer more, then you would need a larger sum of money.

However, if you reflect and are better able to figure out how much you need

Conclusion – What is in store with my spending next year

I think next year will be rather similar.

I might pull off the medical treatment. Next year will also be the last mortgage year for my parent’s HDB flat which I am helping to pay.

Other than that, I got a feeling something will break down around the home soon, although I have replaced a lot of things in the past few years.

Over the year, I have had a couple of readers letting me that they can hit this level of spending despite having a child and at a different phase in life.

I do find it amazing they are able to hit below $30,000 a year given the demands of the modern family.

So this is not unachievable if you set your mind to it.

Yet at the same time, when others look at this, they will poke holes at my single person profile and conclude it is easy for me to do it. I do not disagree.

But I think you will gain if you reflect upon a few things:

- In the future, if I get to Kyith’s position of two adults, will my spending be similar? How different would it be?

- How much am I really spending in a year for my family?

I think the second question is important because we often dismiss tracking expenses as too micro-managing, hard to do, but if that is the case, how can you make a conclusion that it is not doable for you?

You do not even have a number to work with.

If retirement is a goal of yours, then making sense of your income requirement is important enough.

It is the simple basis of retirement planning (which is what the firm I work with specialize in, so I know a little what I am talking about).

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I currently work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

The post My Annual Spending in 2021 – $27,680 appeared first on Investment Moats.