Author: Kyith

Go to Source

Many readers have gotten really good value from yesterday’s slide deck by JP Morgan.

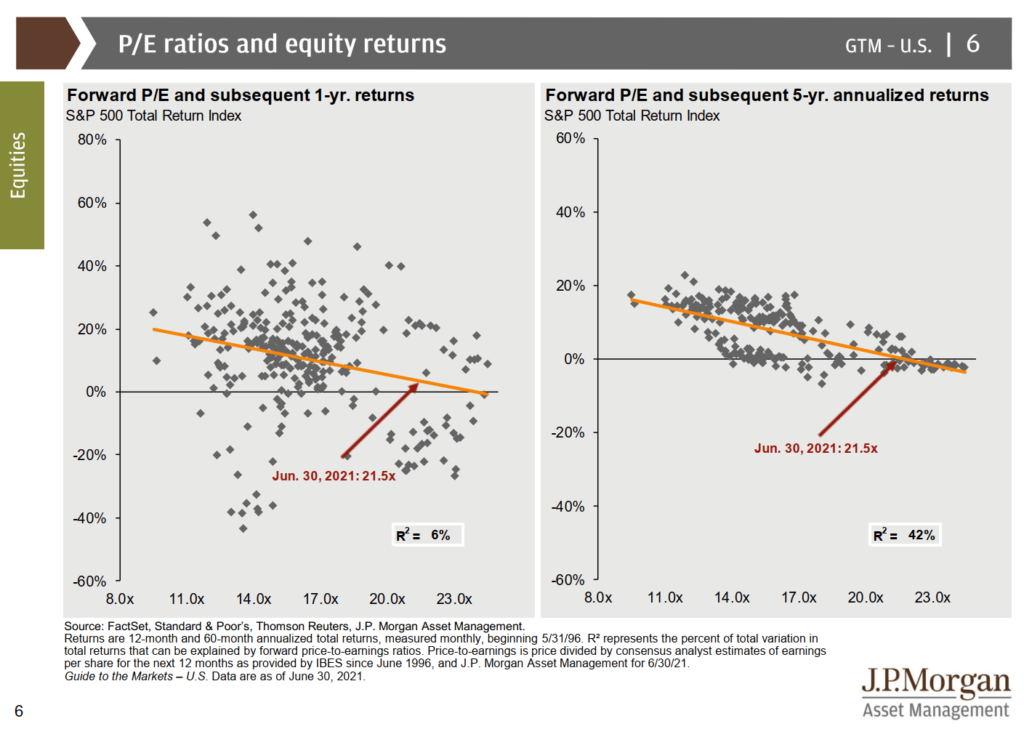

But the aspect that leaves investors concerned was the 5-year subsequent stock market performance after we have a rather high price-earnings read.

Some have asked how I would invest in this climate, and the truth is, 21.5 times PE is above average but you can see that in some instances, subsequent 1-year returns can be 20%.

Usually, low 5-year annualized returns mean that somewhere in the next 5 years, you are going to get a nasty one where it takes the returns down to 0% a year or slightly below that.

I have seen enough of these data at work. It can get rather demoralizing.

The danger for those who are perhaps less sophisticated is that they treat this as a be-all-end-all.

We can always frame things differently.

- While we do not know which factor premiums will show up, we know that the market-risk premium tends to be more consistent and pervasive. The market risk premium is the premium you earn by taking risks, investing in risk assets such as equity over risk-free bonds.

- If you have not accumulated your wealth, you got no choice but to take risks in a sensible way, that will give you a high probability of earning better than average returns.

- Returns could be lower in this sequence, but over the long run, it should still have a high probability of working out.

- Investing in risk assets (property, equity, bonds) is unknown. Past data is used as a guide and we hope things continue. We do have a lot of data of past economic regimes, changes in margins, PE, earnings per share, bear markets, bull markets, technology boom, value doing well, growth doing well, semi-conductors doing well, semi-conductors doing badly to help us form our opinion.

- Annualized 5-year 0% return is not really bad news. It means you put in $1 million and end up after 5 years with $1 million. It is not $1 million you end up with $500,000 after 5 years.

- If the market goes through an environment where your rate of return for five years is 0%, it provides a low price-earnings, depressing environment. That could be the best environment for an accumulator because you should be glad there are more of these environments where prices are more attractively priced.

- The person with 5 years to retirement will also be in a relatively good situation because you are still working, you are still accumulating, you leave that 5 year period and emerge at a time where your sequence of return is great. So instead of a rather conservative 3-3.5% initial withdrawal rate, you may be able to start with a more optimistic 4% initial withdrawal rate.

Data and investing is just one aspect of the equation. Financial planning is another aspect.

And that includes your unique life situation.

How Price-Earnings can Improve Positively

The other thing is that the situation may not be so bad.

Market prices to me is a rough aggregation of = dividend yield + earnings growth + price-earnings expansion + crowd psychology + funds flow.

We will leave crowd psychology and funds flow aside.

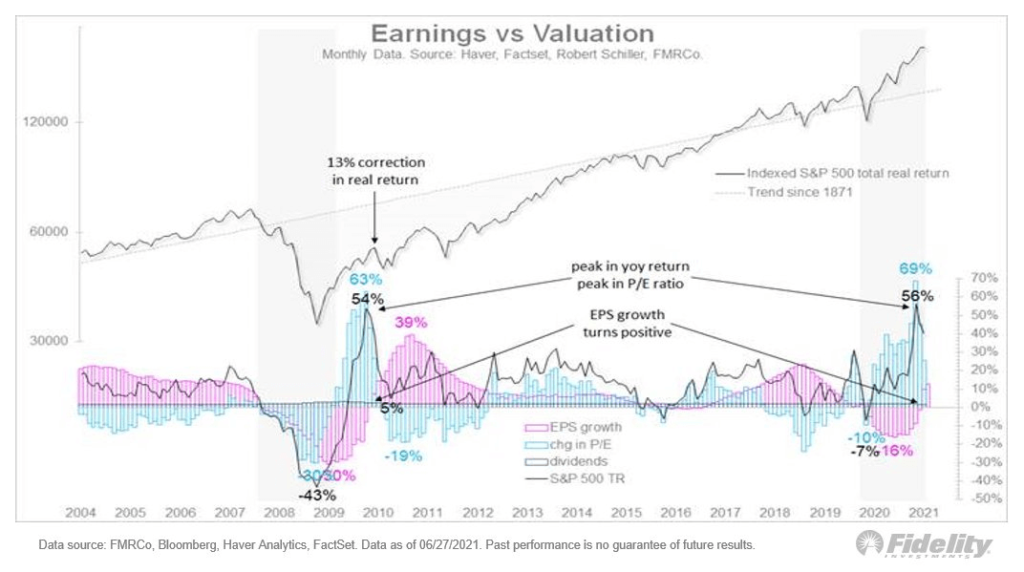

It may be hard for us to visualize this interplay but I found a Fidelity technical analyst Jurrien Timmer who has a great visualization of how this interplay works out for the past 18 years.

This chart shows the changes in earnings growth, price-earnings from 2004 to 2021 start.

COVID-19 and GFC may have some similarities in that prices got depressed to a large degree. Earnings tend to lag the changes in prices. This means that earnings are slower than market prices to reflect the fall and subsequent rises.

If things played out the way they should, we should be seeing some EPS growth over the next two years. JPM uses a forward price-earnings so that baked in the expectation that earnings will improve going forward.

The question is how long is the earnings improvement will last. If it lasts longer than the share price increase, we improve the price-earnings.

The bull market for the past decade is built on the price-earnings expansion (look at the blue bars). That is not the most healthy stuff and we can go into a long debate on whether earnings is the best measure of things going forward.

Ultimately, we may be in a year-2 of a secular bull market. And usually, year 2 of the bull markets are rather rough. It’s not like you gonna see a big plunge, but you get volatility and most of us don’t take to this well.

Another thing to note from the chart is the part from 2004 to 2007.

That is the period where most of us long-timers know no one wants to invest in the USA and wishes to be in emerging markets.

Price-earnings contract. Earnings-per-share grew.

I think that the lost-decade in S&P 500 sets up for the next decade.

Will think reverse?

Maybe. The worse thing for the S&P 500 is a PE contraction. That could work out.

But the music might keep playing.

There is another thing about flow that I have not talked about. But for that maybe another day.

Sign up with the new SG broker Futu SG today till before 30th June and you can receive one FREE Apple share and 3 months of Commission-free trading. All you have to do is open the account and deposit SG$2700 into the account and you can get this welcome package estimated to worth SG$170!

Here are the easy steps that allow you to qualify in a short time.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I currently work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

The post If Future 5-year Returns is Low, then How do we Invest? appeared first on Investment Moats.