Author: Barry Ritholtz

Go to Source

Why are there too few houses in general and too few for sale?

The pandemic has revealed a supply/demand imbalance in the Housing Market, but the reasons are far less obvious than assumed.

Sure, the pandemic sent lots of urbanites out looking for a place in the burbs or a vacation property where they could WFH. But the underlying structural conditions for a massive supply shock were decades in the making. Allow me to chronologically explain how we got to our improving but still short supply of homes.

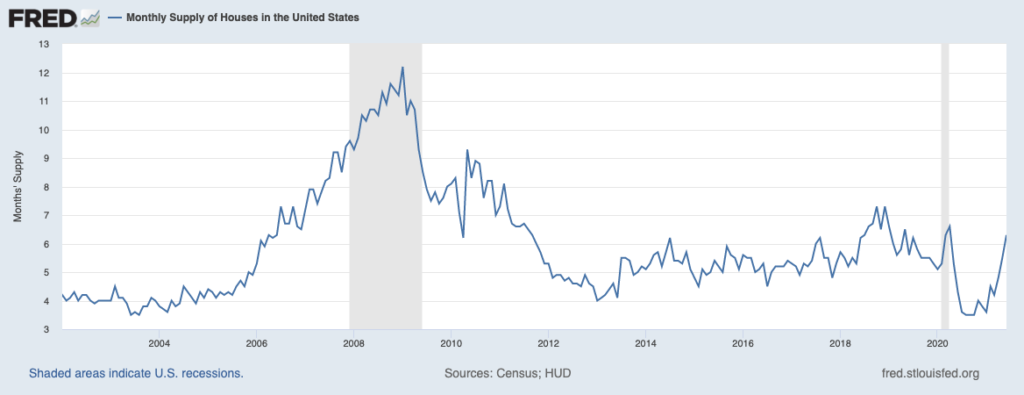

The 20-year chart above shows the ratio of houses for sale to houses sold — it’s not ideal, but it will do for our purposes. Consider what each decade had in store for real estate:

1980s: The ’80s economic recovery saw jobs available and inflation moderating. It was still early days in the epic 40-year collapse of rates. The trade-off for lowered tax rates was the elimination of a lot of tax loopholes1 that favored real estate development. Single-family home building was robust. Coop conversions in cities and Condo construction were getting underway in earnest. Prices peaked around 1989.

1990s: Real estate prices dipped in the face of economic headwinds. Meanwhile, the stock market was heating up. The boom attracted more and more investors. The bond market rallied as well, sending rates lower. I have vivid recollections from the late 1990s of stock investors “taking a little money off of the table” to trade up to a bigger house or a nicer neighborhood. By 1998ish, NYC housing had surpassed the prior condo peak.

2000s (pre-GFC): The stock market crashed, dotcoms imploded, and the Tech-heavy Nasdaq fell 81%. The Fed cut rates to 2% then 1%. But salaries had been lagging, education and health care costs soaring. People are reluctant to lower their standards of living, so mortgage equity withdrawal (MEW) was substituted for wage gains. This was a key factor leading up to the GFC.

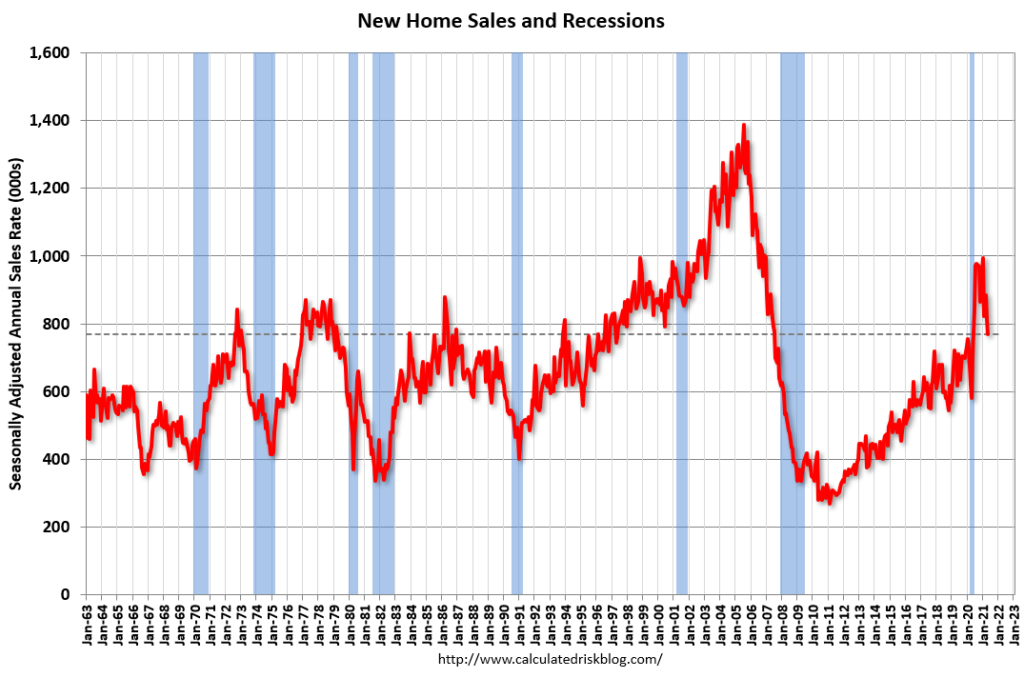

During this period, anyone and everyone could now qualify for a No-Doc NINJA2 mortgage, homebuilders ramped up production far above any levels seen over the prior 40 years:

2000s (post-GFC): The hangover from GFC arrives, and new home construction grinds to a halt. Builders shift to multi-family and apartment buildings. It will take more than a decade for new single-family home construction and sales to their pre-boom average.

Post GFC Household formation is weak, as fewer young people are getting married, starting families, buying homes. No one seems to notice the increase in population + delayed marriages as future home buyers.

2010s: Rates continue downward. The Fed makes a half-hearted attempt to gets off its emergency footing. Home sales improve gradually. Modest amounts of new home-supply are being built.

Beneath the surface, a massive imbalance is developing: By 2013, the stock market begins to make new all-time highs (again). The Class that graduated post-GFC is getting jobs, moving out of their parent’s basements, and getting serious. They ironically pretend not to be interested in material goods like houses.

2020s: The Pandemic sent everyone scambling, but it also led to a year of lockdown forced savings. EVERYONE understood the value of owning your own space. Demand soared. There were few new homes for sale and not a lot of existing homes either. Who wants to move in the middle of a pandemic? And that Eviction Moratorium? It kept millions of units off of the market.

~~~

This is all very obvious in hindsight. The delay in household formation, the lagging new home construction, and the appreciation for your own space all came together to reveal the structural shortage of single-family homes. And that is before we discuss NIMBY and excessive regulations that reduce available land to build on.

More new supply is coming online, more owners are recognizing the opportunity of high prices — they are selling and then relocating to cheaper parts of the country. And low rates? They seem to be sticking.

Eventually, supply will catch up with demand. This is why traders love to say that the cure for high prices is high prices.

Previously:

Not a Housing Bubble (March 30, 2021)

Mortgage Debt Hits Record: So What? (September 4, 2019)

NINJA Loan (September 10, 2007)

_________

1. The 86 tax law decimated new condo construction which was fueled by investors that were writing off passive losses and suddenly couldn’t.

2. NINJA = No Income, No Job, or Assets

The post How Everybody Miscalculated Housing Demand appeared first on The Big Picture.