Author: Joel

Go to Source

The post Gamify Your Money Goals with These 8 Fun Saving Challenges! appeared first on Budgets Are Sexy.

Buenos días, amigas dinero!

Some of these money saving challenges might seem simple and silly… But, that’s the whole point!

It’s a scientific fact that you are 72% more likely to achieve your financial goals if you structure them as a fun and childish game. (And by “scientific fact”, I really mean that I just made this up in my head right now, but it seems legit  ). Having more fun = getting more done.

). Having more fun = getting more done.

A money savings challenge is typically done *in addition to* your regular saving habits, to achieve a short term savings goal. Most of these yield you a few thousand bucks at the end for you to invest, spend, or give away if you’re feeling generous!

Let’s get started!

Oh, and for you high-income super-savers out there who are capable of saving a lil’ faster than regular folks, try doubling the savings numbers (or shortening the time frames) to make it more challenging.

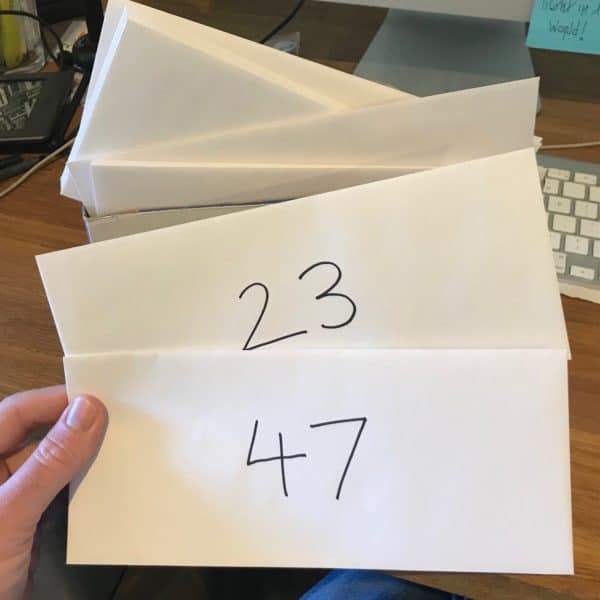

1. Money Envelopes Saving Challenge (Save up to $5,050!)

For this challenge, you grab 100 x blank envelopes and label them each with numbers 1 → 100. Scramble them up, then put them into a box. Each week, pick out 2 x envelopes at random, and whatever numbers you pick, you place that amount of money inside the envelopes.

Some weeks you’ll pick high numbers, sometimes low numbers, but after 50 weeks of saving you’ll have $5,050 in extra cash!

I’ve seen a few versions of this saving challenge floating around the interwebs over the past year or so. Depending on how much you wanna save, you could modify the challenge accordingly…

-

- 100 envelopes, open just 1 each week = $5050 in 2 years!

- 52 envelopes, labelled 1 → 52, open 1 each week = $1,378 in a year!

- “The back half”: Only 50 x envelopes, but label them starting at #51 → 100 to skip all the low numbers. This’ll get you $3,775 in a year 🙂

I know the year is already underway, and it seems weird to start a 52 week savings challenge in February… But, it’s not too late to play catch up. Start by opening 5 or 6 weeks of envelopes all at once in the first month! Or, double up envelopes in a certain month when you expect a higher paycheck, etc.

2. A 52 Card Pickup Challenge (Save up to $1,352!)

This money challenge involves a deck of cards. Similar to the envelopes challenge, you shuffle all the cards and pick out 2 cards at random each week.

Add up the numbers on the face of each card you pick, and this is the amount of dollars you need to save that week. (Jacks = $11, Queens = $12, and Kings = $13. And if you want to keep Jokers in the deck, you could assign them a ridiculous number, like $100 if you pick a Joker)

For example, if you pick a 7 and a King, you gotta put $20 in the piggy bank that week.

Here’s the kicker… Instead of discarding the cards after you draw them, you put them back into the deck each week. This keeps it fun and interesting because you never know if you’re picking high numbers or low numbers!

The lowest amount of money you’ll save after 52 weeks is $104. (picking 2 x Aces each week) The highest is $1,352 (picking 2 x kings each week). But those are extreme odds.

On average the weekly savings will add up to ~$728 for this 52 week money challenge!

Bonus challenge: Pick up one of these money decks in which each playing card has a small educational money fact on it. May as well slowly increase your personal finance knowledge while you’re playing throughout the year!

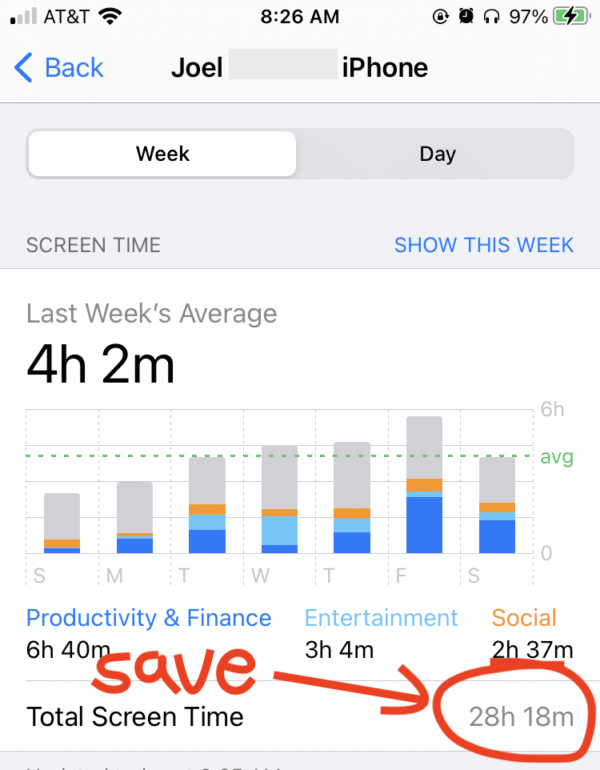

3. Weekly Screen Time FINES (Save $500 – $3,000)

This one is a great idea helping 2 different ways in your life… Reducing screen-time AND boosting your savings account!

Basically, at the end of each week, you navigate to the Screen Time section of your smartphone, and pay yourself a “fine” for the number of hours you spent on your phone that week.

Here’s a screen grab of mine for example. Kind of embarrassing… My total screen time last week was 28 hours! OUCH.

Did you know… Scientific research shows that by year 2030 the average person will be on their phone for 19 hours per day!!!?? (I made this statistic up too, but wouldn’t be surprised if it actually comes true given the amount of zombies I see glued to their phones out there  )

)

In all seriousness, a weekly reminder of a bad habit (screen time), that is paired with a good habit (saving money) can help both ways. Given my average screen time of 28 hours per week, I’d have around ~$1,500 in extra money aka “fines” at the end of a 52 week challenge.

4. Let the Good Savings “Roll” (Save ~$1,277)

This saving challenge is kind of like the card pickups, but instead of cards, you roll dice! And instead of weekly, you roll daily!

Starting with 1 dice, rolled once per day, you save the number it lands on each day for an entire year. Rolling all 1’s for 365 days straight is the lowest you’ll save ($365), but that is as practically impossible as rolling all 6’s each day ($2,190). More realistically, you’ll end up closer to $1,277 on average in savings!

Not enough for you? Try rolling 2 x dice. Or even 3? Or……

Better yet, grab one of these Polyhedral 100 Sided Dice with numbers 1 through 100. Be careful though… Rolling this bad boy each day will get you saving an average of $18,000 after 365 rolls!

5. “The Best Deal” Savings Challenge (Compete against friends & family!)

This money challenge involves a group of friends to compete against. First, you set up a group text chain, WhatsApp group, Facebook group or whatever so all the members can talk to each other…

Then, everyone within the group shares at the end of each month their “best deal” that they found throughout the past month. It could be that someone saved $300 by switching car insurance, one person might have double-dipped with coupons to get a killer discount on a big purchase, or perhaps someone found some free stuff on Craigslist and sold it for $200 profit.

Everyone HAS to bring a deal story to the table. After hearing everyone’s stories, the group collectively decides who wins “the best deal” that month. Could be a highest dollar amount, funniest story, or whatever.

Here’s why this group challenge is awesome:

- It promotes a culture of “winning”: Sharing your success stories and celebrating other people’s successes is soooo important in life. It boosts morale, motivates people, and rewards good progress.

- You look for wins more regularly!: Throughout the month, you’ll notice yourself looking for more deals, because you want to bring an awesome story to the table when the group meets. As others share their stories, it’ll open up more ways and areas for you saving money.

-

It helps your friends (they need it)!: Some of my friends look down on frugal living, and would scoff at a regular “money saving challenge.” But a “best deal competition”… they’re in! Little do they know you are helping them reduce spending, and subtly preaching good personal finance habits

.

.

6. Weekday No Spend Challenge: (52 x $0 spend days!)

This is a little different than the regular “no spend challenge” where people typically take 1 full month off of spending. Instead, this challenge is just picking 1 day of the week, and not spending any money on that particular day for an entire year.

What I like about no spend Wednesdays (or whatever week day you pick) is that it slowly forms habits that actually last. Making lunch instead of buying it, not grabbing that guilty pleasure energy drink on the way home, inviting friends ‘round for a board game instead of meeting them at the bar, etc. It’s one thing going cold turkey for a month on spending, but a weekday no-spend challenge is a small, repetitive goal that gets you more conscious of your behavior.

Another cool thing is it actually saves more than the 1 month long no spend challenge. A month of no spending only saves 30 days of money. But a full day off each week is 52 x days of no spending. Almost double the impact.

As for the total amount of money saved, you could figure out your average daily spend outside of essentials (add up your amusement, dining, discretionary spending categories in your budget, divide by 365), then set that money aside each day in a specific checking account. Or, pulling the money out in cash is always a great idea, because it removes the dollars when you are checking your digital bank account balances or net worth, making it feel like “extra money” at the end of the year!

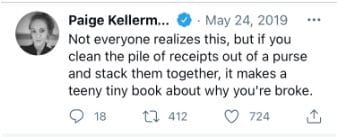

7. Receipt Savings Challenge:

Ever seen this funny tweet or meme?…

@PaigeKellerman on Twitter

Haha! It’s funny because receipts don’t lie. They reveal both bad spending habits as well as good ones.

For my wife and I, I like to think we are the opposite of this being broke statement… If you compile all of our receipts and stack them together, it would make a teeny tiny book about why we’re rich. Because most of our receipts would reveal discounts, promos, and weekly ad deals! (it would also reveal that we prolly drink too much, but that’s another story!)

OK here’s the receipt challenge…

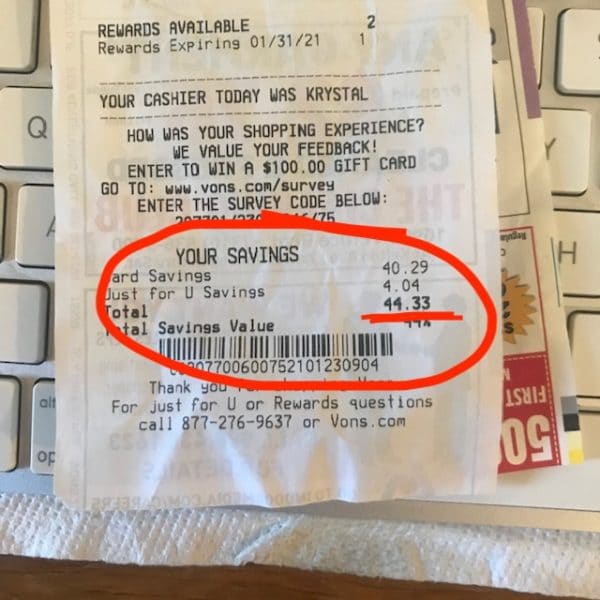

Every time you hit up the grocery store, pay attention to the “discounts” and reduced price items you’re buying. Most stores total your savings at the bottom of your receipt when you check out. Here’s one my wife brought home from shopping recently:

Each week, total up your savings and transfer that money to a separate savings account. In this example, I’d throw $44 towards my savings goal.

You could say that this money is already “saved” because it wasn’t really charged to you in the first place… Yes, that’s correct, and by manually moving the money to a separate account you are actually paying yourself, instead of the retailer.

Building up that money in a separate account means you won’t accidentally spend it elsewhere. Not to mention, keeping track of your savings on a regular basis makes you more aware of discounts on future shopping trips.

8. Save all $5 and $50 Bills Challenge!

A while ago I read a challenge about saving every $5 bill you come across within the year. Sounded awesome! But, then it hit me that I rarely use cash. When I do use cash, it’s either spare change coins for the parking meter, or large $20 and $100 bills for cash deals at Estate Sales.

Since $5 bills are rare for me, I’m including $50’s in this challenge as well. Sure, it’ll hurt if I sell something on Craigslist for $500 and the person pays with 10 x $50 bills. But, that’s the challenge! It’s supposed to be hard!

I wonder how much I can collect in a year of $5’s and $50’s?

Or can anyone think of a digital money saving game similar that replaces the physical cash aspect of dollar bills?

Saving Money Challenges & Tips for Actually Finishing Them…

Many people start up a fun money saving challenge, then as time goes on they either forget weekly check-ins or lose motivation. So here are a few tips for success:

- Set weekly reminders in advance: A recurring phone alarm, a calendar reminder, pop up alerts, post-it notes, printed wall money saving chart… Whatever you can do to remind yourself weekly or monthly to stay on point will increase your chances of success.

-

Get an “accountabilibuddy”: It’s awesome when friends want to participate in the challenge with you (or against you

). If nobody wants to join, that’s ok. Just making your challenges public and talking about them will hold you accountable.

). If nobody wants to join, that’s ok. Just making your challenges public and talking about them will hold you accountable.

- Have a specific reward in mind: Saving money just for money’s sake can be a bit boring. It helps if you have an idea of where the money will be put or spent at the end. A holiday trip, extra money for Christmas presents, beefing up your emergency fund, etc. For you investors out there, this extra cash could become “play money” to buy a few individual stocks you want to own outside your regular index fund strategy. Just an idea to keep the fun going and compounding after the challenge is over. 🙂

- Don’t bite off more than you can realistically chew: If you set a goal that’s too high, it can kill your motivation if you don’t end up achieving it and leave a bad taste in your mouth. Start with an easy money saving challenge that you can crush!

Remember, the whole point is having fun. 🙂

Have a kick-ass day,

– Joel

The post Gamify Your Money Goals with These 8 Fun Saving Challenges! appeared first on Budgets Are Sexy.