Author: Kyith

Go to Source

I have a cousin in her late 30s, who is part of the sandwiched generation. Last year, due to the pandemic, her job security was under threat. She feared the worst and tightened her belt, just like many Singaporeans. Thankfully, with the Government’s support schemes, she managed to retain her position.

Last week, I received a call from her seeking advice on how to better manage her savings. I found out that her emergency funds have far exceeded 6 months of her income. She is now keen to make her money work harder for her instead of leaving them in the savings account.

It appears that my cousin is part of a growing trend.

OCBC Financial Wellness Index

In 2019, OCBC launched the inaugural Financial Wellness Index to measure the state of Singaporeans’ financial wellness. A total of 2,000 working Singaporeans aged between 21 and 65 were surveyed.

According to the 2020 survey results, unprecedented Covid-19 pandemic has dragged down Singaporean’s financial wellness. The loss of jobs and cut in salaries have hit many Singaporeans hard, hampering our ability to pay off housing loans and monthly credit card bills. Regular passive income was adversely affected too with the weakening economy. Unsurprisingly, fewer Singaporeans said that they can spend comfortably. With more pressing immediate financial worries at hand, Singaporeans had to put the longer-term financial goal of retirement on the backburner.

Now that the worst appears to be over for Singapore, more Singaporeans, like my cousin, are concerned to build their wealth for retirement now.

Majority of Singaporeans Are Not on Track for their Retirement

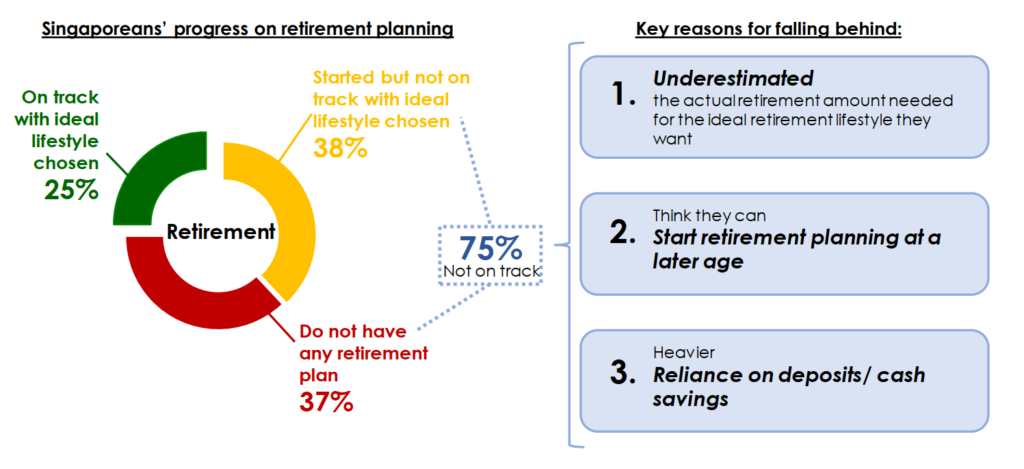

In 2020, 75% of respondents struggled with their retirement plan.

38% of respondents are not on track with their ideal retirement while 37% do not have a retirement plan. This is indeed a major concern.

The reasons quoted for falling behind were:

- Underestimated how much their ideal retirement will cost

- Started planning too late

- Using financial products that have a lower rate of return

What May be the Reason for Singaporean’s Retirement Planning Struggles?

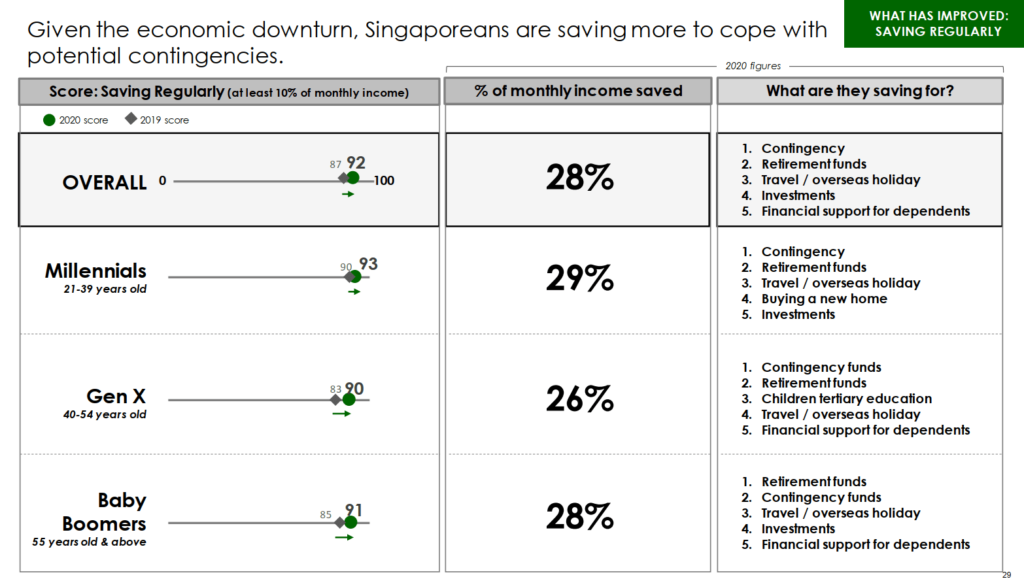

The survey showed that respondents have improved their ability to save regularly (from 87% to 92%) and be able to sustain financially for 6 months better (60% to 61%).

However, their regular passive income has massively declined (42% to 28%). Most likely, this was due to a series of dividend cut from regular dividend-paying stocks.

If I were to guess, Singaporeans feel that they need to save up for large contingency.

The survey results tell us that Singaporeans are saving a very healthy rate, and each has its own set of money priorities that they wish to save up for.

The Millennials and Gen X list contingency funds as the higher priority and retirement funds as the second-highest priority.

It is likely that the respondents considered their savings this year as saving up for rainy days. Only if they felt successful in their contingency savings would they consider contributing more to retirement.

Improve Daily, Short-term Money Management May Free Up Resources for Longer-Term Retirement Planning

Singaporean’s focus on contingency savings as the highest priority saving goal is understandable. The main driving factor for being doubly prudent with money is when our rice bowl is under threat.

For freelancers and the self-employed, the pandemic have affected their businesses to different degrees. There is a real possibility that they need to tap into their savings to shore up capital for their business or pay for their living expenses.

All these reasons could force us to go into a defensive mode to save as much as we can. In our mind, we label this as contingency fund. As such, our longer-term retirement planning is affected. If only there is someone to give us a nudge to highlight that we have accumulated enough contingency fund and we can use the rest for other purposes.

Also, not everyone has a cousin like me to advise them on their next step.

We need a financial software that is well-integrated with a banking platform that will help us in make better financial choices.

A Holistic View of Your Financial Situation with OCBC Financial OneView

When I got to know about the suite of financial planning tools on the OCBC Mobile Banking app, I was excited by what it can do. If you are an OCBC banking customer, you can now make use of their digital banking platform to help budget and track your expenses almost automatically.

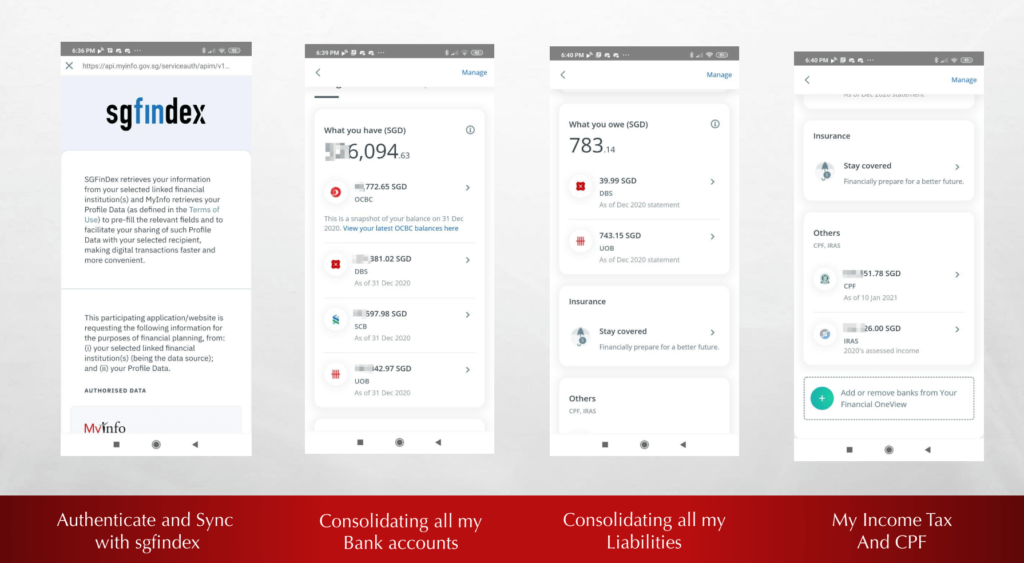

Not only that, with the introduction of SGFinDex, we can now have all our financial data on OCBC Mobile Banking app. (You can read about how to set-up SGFinDex here ) With more accurate data incorporated, OCBC Mobile Banking app has become a powerful tool in helping with our retirement planning.

OCBC Financial OneView allows you to review your various banking accounts on one platform.

In this example, my DBS, SCB and UOB accounts and credit cards were consolidated and sync to the OCBC platform. I could also review my CPF account balances and income taxable income all on this one platform.

With this consolidation of numbers, it will help in my life goal planning.

OCBC Life Goals and Budgets

OCBC Mobile Banking app has various tools to enable us to achieve our financial life goals.

For a start, OCBC Life Goals helps to democratise financial planning and enable Singaporeans to achieve financial wellness by making financial planning holistic, personalised, and simple.

I could go through each of the features of OCBC Life Goals can help you create a better financial life but perhaps it is easier for me to show you how we can seamlessly integrate OCBC’s platform into your daily life.

Tracking Your Spending and Setting Budgets to Control Your Spending

In personal finance 101, the first thing we have to do is to grow our war chest. To do so, we have to set a budget and track our spending. With the OCBC Mobile Banking app, you can set-up budget limits on your OCBC bank account and credit card spending with ease:

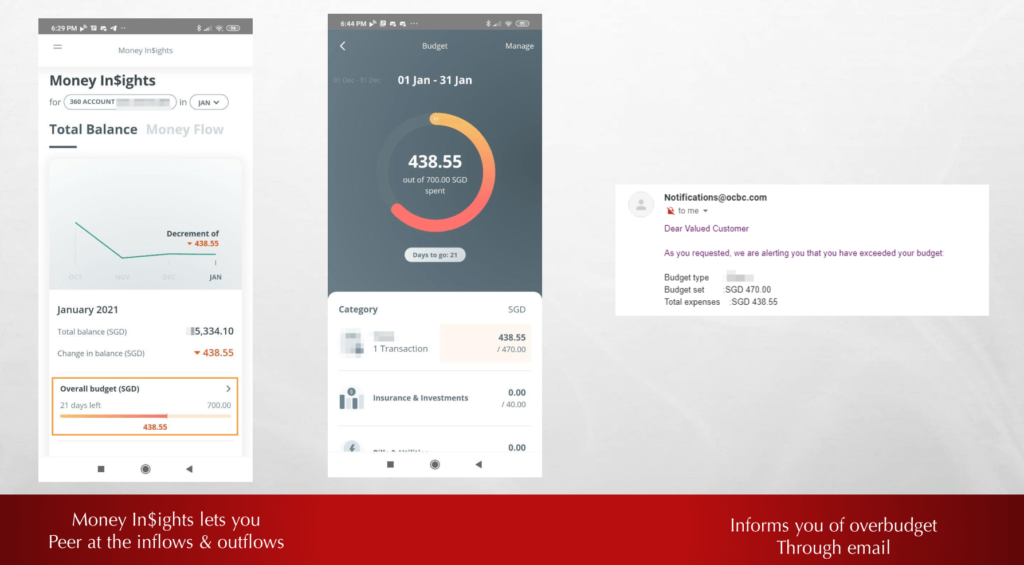

Under Money In$ights, you can review how much cash is going in and out of your OCBC bank accounts. You can set a monthly budget for various expenditures. In the example above, I have spent close to the $470 budget I have set. So an email notification will be sent to me to inform that my spending in the category is flirting close to the limit.

If you are someone who charges most of your expenses to credit cards to earn cashback or miles on our credit card, OCBC Mobile Banking app can track and allocate your spending on OCBC credit cards to the respective budget that you had set. Everything will be automated! And if you are setting the budget for the first time, it will recommend allocations based on the average spending in the previous months.

This function can greatly help us to control our spending and have a better view of what we are spending on. We can then decide where to trim the fats, if necessary.

Use Life Goals and Savings Goal to Plan for Your Intermediate and Long-Term Goals

After you have mastered the art of controlling your expenses, the next phase is to better allocate your surplus to your different goals.

Each of your goals has a different duration and the different amount that you will need to fulfil the goals.

- The longer-term goals have a longer runway, you can afford more volatility for greater returns. A higher return will dramatically reduce the capital needed to fulfil that goal.

- The intermediate-term goals have a shorter runway. You can afford to take a risk but not too much.

- The short-term goals have the shortest runway. You cannot take many risks because if you need $500, you need to make sure that you have $500 and not a cent less.

OCBC’s Life Goals and Saving Goals is quite interesting to me because I think it is a sensible implementation to help your short- and long-term goal planning. The illustration below shows you how OCBC’s Digital can help in your financial planning.

The illustration below shows you how OCBC’s Digital can help in your financial planning implementation:

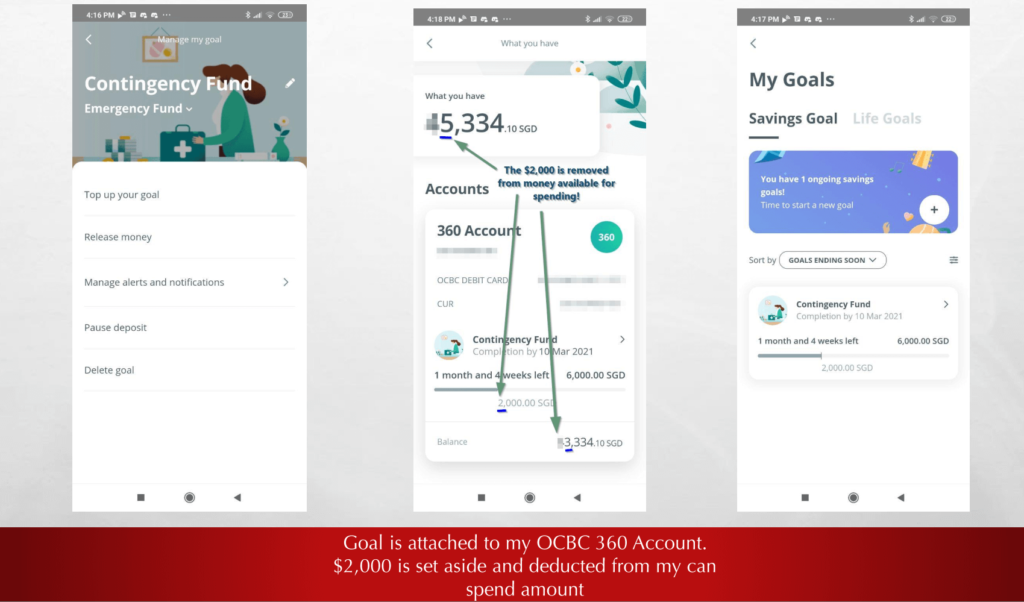

Let’s say you have an OCBC bank account with $11,500 and you have defined 3 Savings Goals. These are short-term savings goal that you will need to build up to. Based on your priority, you can allocate the current money you have to each of these goals.

Over the next few months, you will fund this Savings Goal from your OCBC bank account plus any salary or cash inflows that comes into the account. OCBC Mobile Banking app can help you to “block out” the money already allocated in these savings goal. So although you have $11,500 in the account, only $2,500 is available for spending.

The longer-term goals, such as Child Education and Financial Independence, can be funded by money from this OCBC account into separate OCBC investment accounts via unit trust Regular Savings Plan (RSP)

The elegant thing about OCBC’s implementation is that it can successfully help you separate all your Savings Goal, Life Goals and Spending money, preventing them from crossing with each other.

This will give you a better mental picture of your money situation and create greater financial sanity and stability.

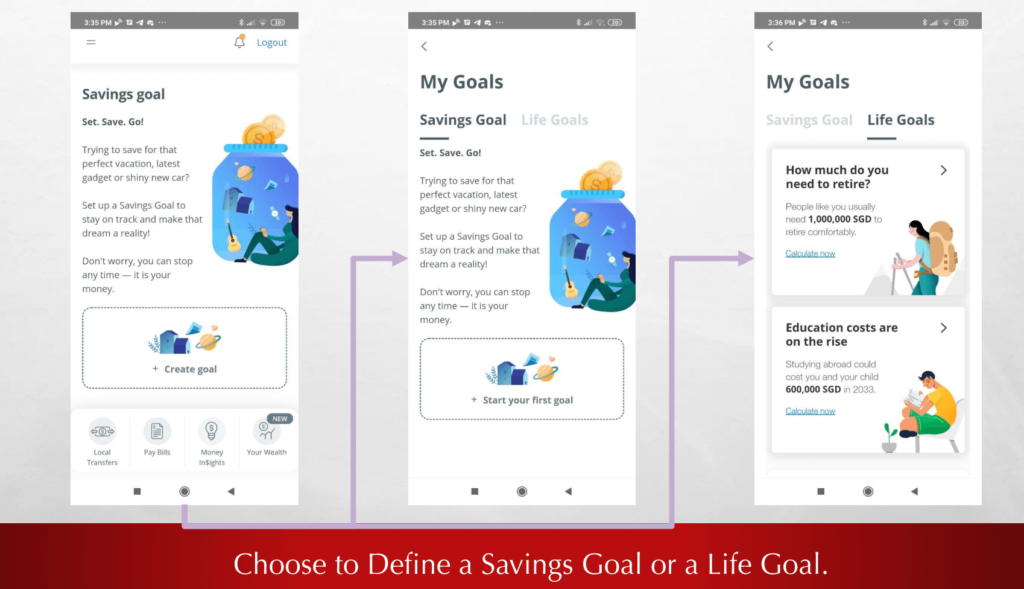

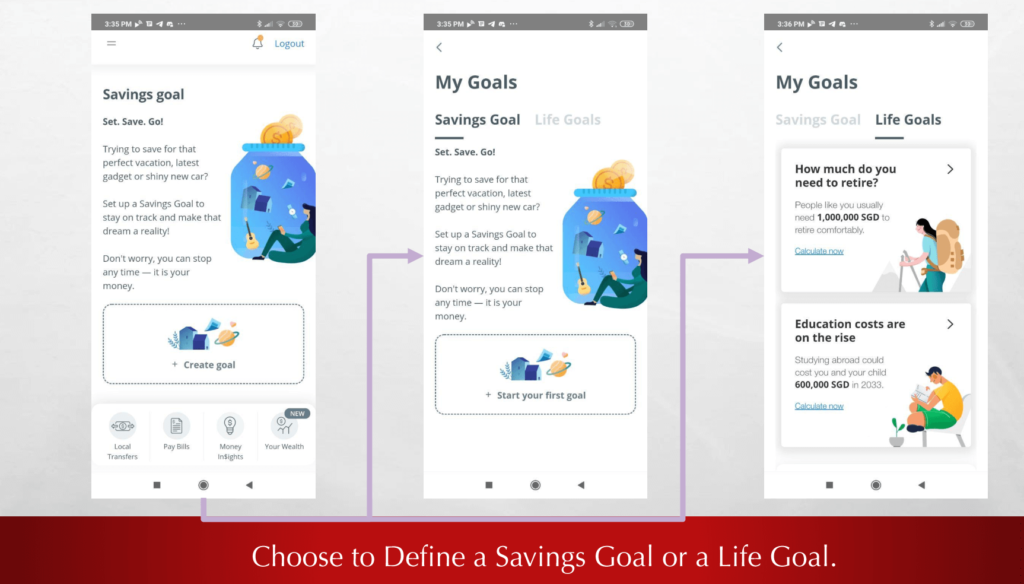

You will start your journey by defining either a Savings Goal or Life Goal.

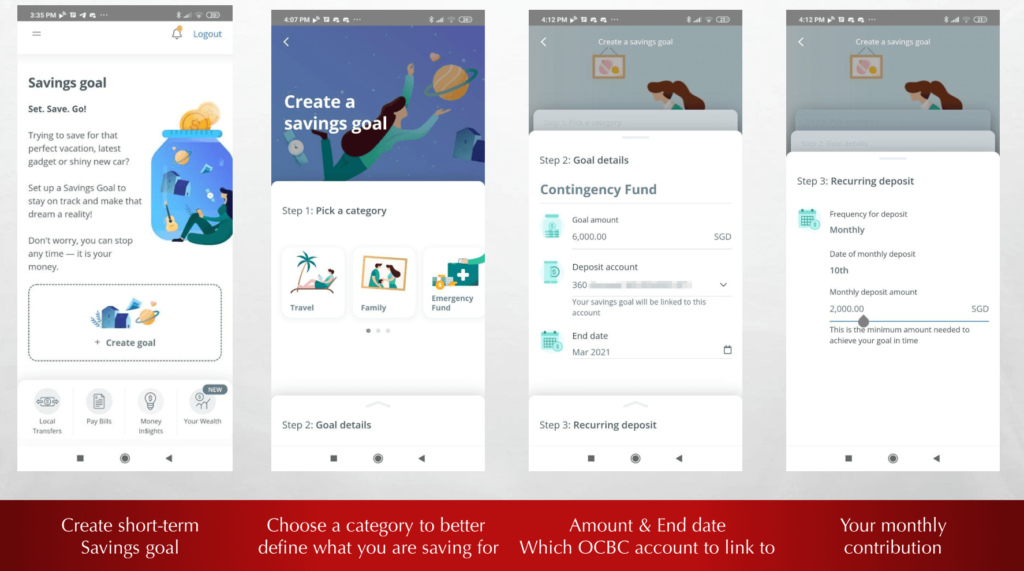

Let us define our short-term savings goal first.

Creating a Contingency Fund Savings Goal

I have defined a Contingency Fund with a goal of $6,000 by May 2021. OCBC Mobile Banking app helped to compute that I would need to make a monthly contribution of $2,000 to successfully fulfil the goal.

I will tag this Savings Goal to a specific OCBC savings account. This means that you can have different savings goal tagged to different OCBC savings accounts.

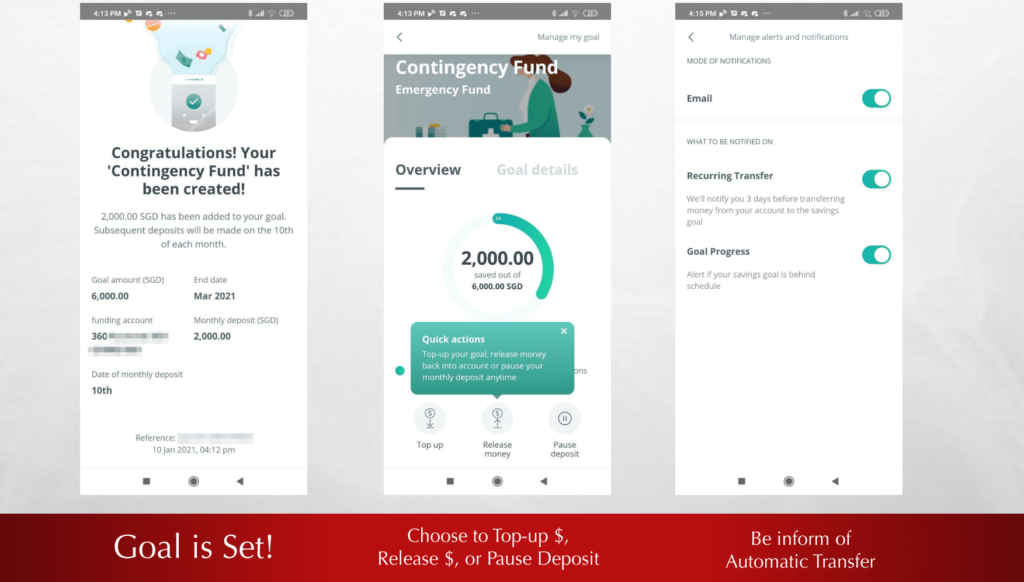

Once you have created the Savings Goal, it will let you see your progress.

The very exciting thing for me is the way they design this Top up, Release money and Pause Deposit system.

This allows you to control the flow of money between this goal and your bank account.

In the past, OCBC also had this Savings Goal feature. From what I remember, this implementation is even more robust.

Like I said previously, the $2,000 that I have contributed cannot be spent unless I release the money. Long-time readers would know how much I like the concept of envelope budgeting (You can read my complete budgeting guide here)

OCBC’s Savings Goal tool allows me to create numerous “virtual envelopes” and compartmentalize money away.

Here are some “virtual envelopes” I used:

- $585 for my annual term life insurance premium

- $250 a month for medical fund

- $100 a month for parent’s fund, which will later be invested or use for some emergency

- $200 a month for a household fund, to buy the things that will eventually need replacement

If you wish to get a handle of your spending, you should really try out this feature. Let me know if it works for you too!

Creating and Funding Your Financial Independence Life Goal

Retirement planning is probably my bread and butter.

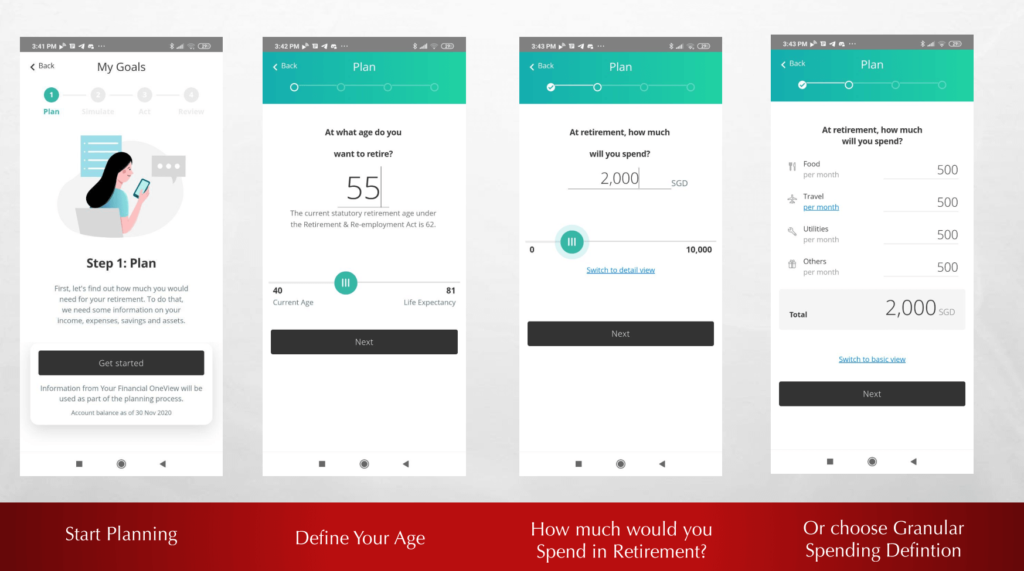

We can start this journey by choosing a Life Goal and by selecting how much I need to retire. We all have different ideas for our retirement, so you will have to start thinking about yours today.

I like how OCBC Mobile Banking app guide us through a series of questions using easy-to-understand terms and simple, clean-cut interface.

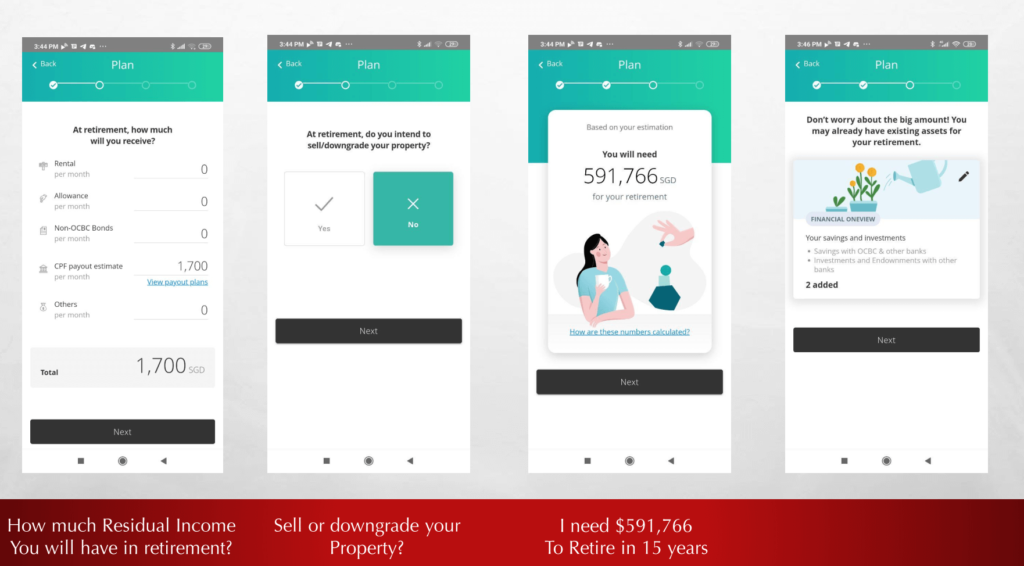

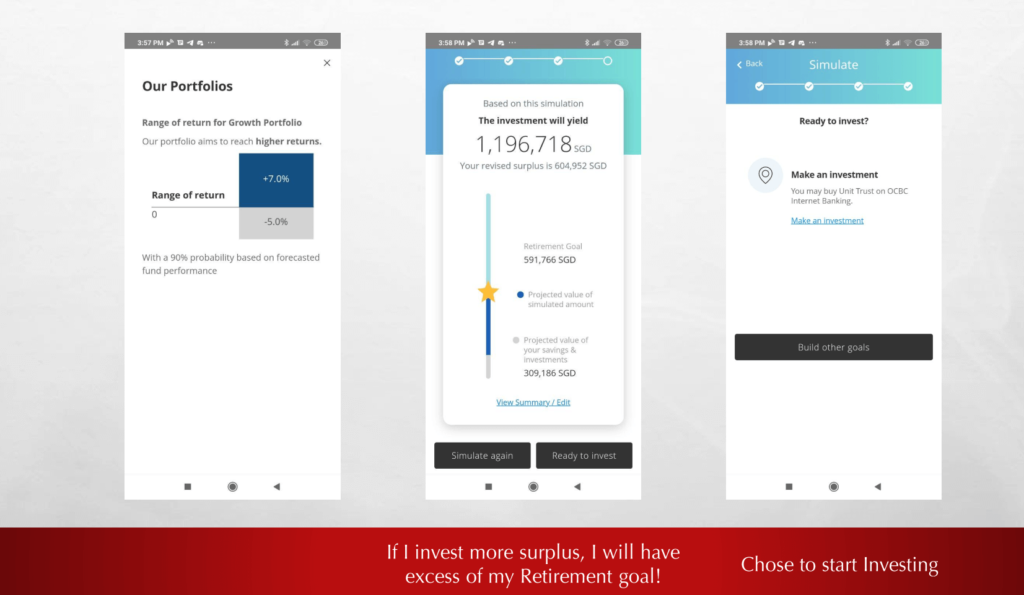

After defining the additional residual income I will have and whether I wish to downgrade my home, the application computed that I will need $591,766 to retire 15 years later.

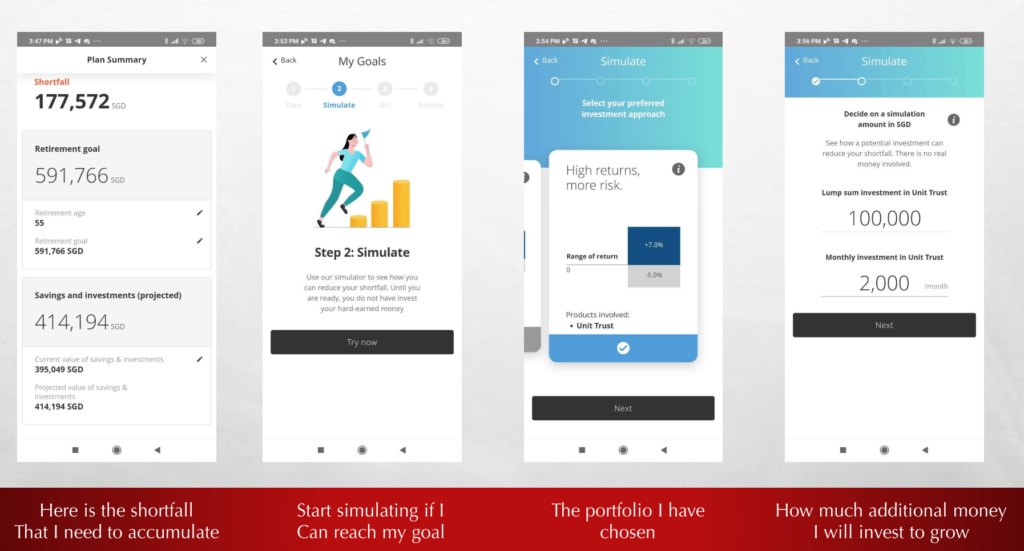

OCBC made use of the consolidated data on Your Financial OneView made possible by SGFinDex, to inform me that I have a shortfall of $177,572. To make up for this shortfall, I might want to consider to make my money work harder for me by investing.

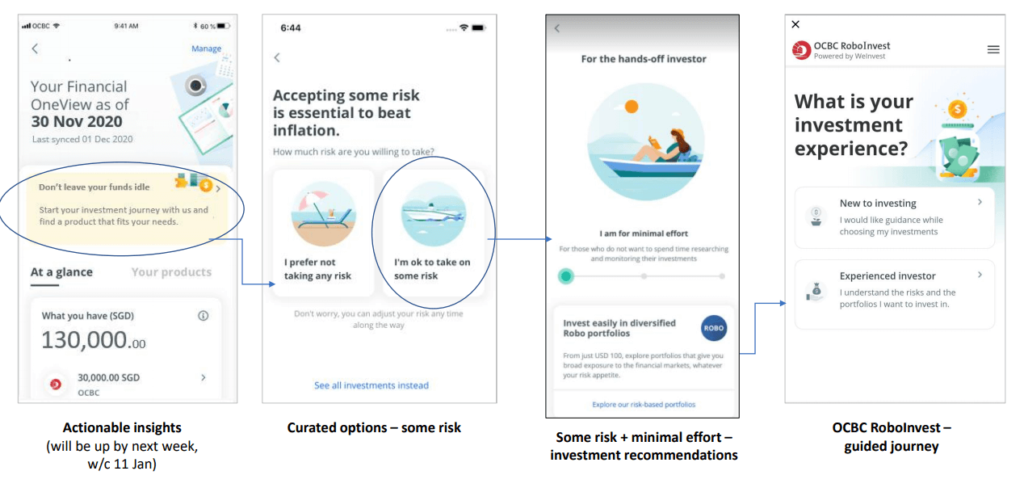

Many readers often told me they are keen to start investing, but they are not sure where to start. The team at OCBC understands this, so they have done up a self-guided investment journey on the OCBC Mobile Banking app to help you through.

Your risk appetite and your investing style are taken into consideration when recommending a personalised portfolio for you. If you are new to investing, more guidance will be provided to help you choose the investments most suitable for you.

In my case, I chose to invest in a higher risk Growth Portfolio. With that, I will be able to exceed what I need 15 years later.

In Conclusion

Managing our finances can be especially daunting in a difficult time like this. It helps when we have a clearer insight of our life goals.

With the suite of offerings on OCBC Mobile Banking app, you are able to:

- View and Understand all your money in one place

- Maximise your money with Personalised insights

- Take concrete action to achieve your Life Goals

If you are feeling lost like my cousin, do give the OCBC Mobile Banking app a try today to guide you through this journey.

This article is written in collaboration with OCBC. The views belong to Kyith.

The post Fulfil Your Life Goals with OCBC Digital appeared first on Investment Moats.