Author: Tyler Durden

Source

Authored by David Messler via OilPrice.com,

-

The EU gas storage units are nearly full giving some relief to fears of shortages

-

Challenges remain for the continent’s energy security as winter arrives

-

The challenges will persist into the winter of 2023-24.

The worst energy security fears of spring and summer as regards the coming winter in the European Union-EU, have been somewhat allayed. Earlier this year when war broke out in Ukraine and it became clear that the conflict would drag on for months, if not years, the EU appeared perilously in danger of a winter “Polar-Geddon,” as cold air gripped the continent. Largely forgotten and retired gas storage caverns, that hadn’t been filled in the expectation of a steady supply from Russia via the Nordstream I and II pipelines, suddenly were thrust front and center into the public eye. Troubles often come in twos. The next shoe to drop was the deflation of expectations of much of the EU electric grid base load being met by wind and solar farms, when the elements refused to cooperate. Beginning in the middle of last year, it was noted that the wind wasn’t blowing and the output of solar farms was less than predicted. These two events appeared ready to converge upon the EU and presenting it with a stark, and chilly future for the winter of 2022-23.

As is often the case, the fullness of time alleviated the worst fears as energy leaders in the countries that make up the EU, sprang into action. They turned to Norway for an additional 90 bn cubic meters of gas to begin filling the storage caverns. The infrastructure was in place, it was just a matter of price. The also U.S. responded with a massive sealift of billions of cubic feet of LNG, mostly from the Gulf Coast Cryo plants, and little by little the starkest fears of early spring were put to rest.

Now the WSJ reports that EU gas caverns are largely filled, thanks to U.S. LNG exports. Europe’s population is now in Nature’s hands as winter approaches.

“Storage facilities of gas for heating and power generation are almost full, consumption is down and liquefied natural gas tankers are steaming in. Europe is in a stronger position than feared in recent months, after Moscow slashed gas deliveries in retaliation for Western sanctions over the invasion of Ukraine.

However, much could go wrong. One long cold spell or a busted pipeline could upset the region’s preparations, threatening emergency rationing, blackouts and a deeper economic recession. Officials and analysts say the willingness of consumers to cut back on gas use will be key for getting through the winter.”

The focus of the rest of this article will be on what indeed could go wrong, and put the citizens of the EU in jeopardy.

Asian demand, energy cutback compliance, and the weather in the U.S. could make the difference

While seemingly out of the woods for the early part of this season, with full storage caverns, several challenges lie ahead for this energy beleaguered continent.

The first is that Asian demand, and in particular Chinese demand is expected to resurge in the coming months. The focus on the Eastern Hemisphere is understandable as its growing economies are the product of this regions ascendancy as manufacturing and distribution hubs for nearly everything. This relentless demand, should it occur will challenge the import hubs of the EU, as they begin discharging stored gas this winter and begin looking for new supplies to address the winter of 2023-24.

Bloomberg noted in an article recently, that China which had been reselling cargoes of U.S. LNG to the EU for a profit, was no longer doing so.

“China told its state-owned gas importers to stop reselling LNG to energy-starved buyers in Europe and Asia in order to ensure its own supply for the winter heating season.”

If this action signals a turn in China’s outlook, then EU buyers will face increased competition for U.S. supplies, of which over the summer they received the Lion’s Share. Loaded LNG cargoes are very fungible and it is common for the final destination of an LNG carrier to change after it departs port.

The second is making it through this winter without the draconian cutbacks discussed in the WSJ article. Compliance with the urgent conservation directives will determine if EU energy security is at the mercy of the weather this winter.

“Europe is probably as well prepared as it could be. The infrastructure is pretty much maxed out,” says Michael Bradshaw, professor of global energy at Warwick Business School. “We are up against the hard reality that there are physical limitations to the ability to replace Russian gas in the short term. That means that doubling down on the demand-reduction side of the equation is vital.”

“A lot could go wrong. If freezing weather jacks up demand, stockpiles could drain and prices could shoot to levels that hammer companies and government finances. Low temperatures could also spark a contest between North America and Europe for LNG supplies.”

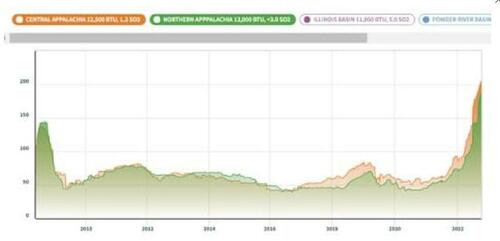

And that leads us to our third point in this macro thesis. It is only pure serendipity that things aren’t much worse in the U.S. than they are. Sky-high prices for coal have kept U.S. utilities burning gas this summer for electricity generation. That should have kept prices higher than they were. What happened?

You perhaps remember that fire in the Freeport LNG plant near Galveston in June? It had the effect of putting 2-BCFD back on the market, and available for injection vs export. Hence we are only ~4% under 5-year averages in our storage. This week.

It will be interesting to see what sort of draws are seen in next week’s report as a big chunk of the nation feels winter’s first blast. Nor am I optimistic, absent a big surge in gas drilling, that we will be able to do anything to materially impact this tight supply scenario.

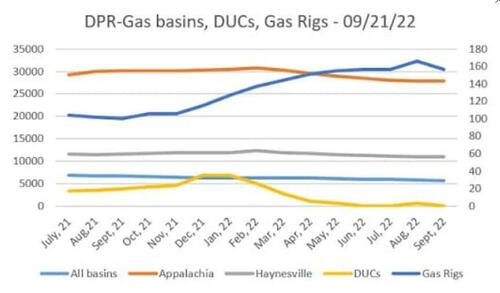

The trend isn’t encouraging for mid to long term new supplies as noted in the chart above. This is compiled from data put out by the EIA and only measures a running average between production noted in various reports and the number of rigs turning to the right. A simplistic measure as I have noted in past reports, but trends are instructive of their own accord. And the trend suggests, for whatever reason, well productivity is declining.

Your takeaway

The challenges for the EU will remain through to the heating season of 2023-24, depending as we have noted in this article on the weather on both the European and North American continents. This will drive prices for gas which have fallen sharply over the third quarter.

One way I am looking to arbitrage this price action is selecting producers that stand to benefit. One I am looking at in particular is a Canadian player, ARC Resources, (TSX-ARX). It is Canada’s third largest gas driller, with high margins and access to U.S. southern LNG hubs and east to the big population centers of Toronto and Montreal. ARX is generating free cash at a rate of $2.0 bn CAD, and has growth plans that are covered by Free Funds Flow. ARX pays a modest dividend, currently yielding 2.7%, and trades current at 6X EPS. There are others worth considering as well. Tourmaline Oil Corp, (TSX: TOU) is one of the country’s biggest gas drillers with 80% of its daily production comprised of 2.2 BCFD. It is trading at 9X EPS, which is why my interest has run more to ARC Resources.

I like the Canadian gas drillers as opposed to the big American gas drillers due market access. EQT, (NYSE:EQT) and CNX Resources, (NYSE:CNX) among others draw on the Marcellus super-basin for their reserves. The Marcellus is locked behind the Appalachian Mountains with no pipeline access to the big consumer markets in New York City, and Boston. In spite of years of work by pipeline builders to obtain permits to build the Mountain Valley Pipeline, and Atlantic Coast Pipeline, both are still incomplete with no clear pathway to completion.

Whichever way you go, I think the gas drillers are a safe bet if a cold winter here and in the EU challenges supplies as we have discussed.

Tyler Durden

Sat, 10/22/2022 – 07:00