Author: Jason Lemkin

Go to Source

The Harvard

Business Review Entrepreneur's Handbook: Everything You Need to Launch

and Grow Your New Business

Free $0.00 Amazon

Crunchbase has its latest VC report up here and it’s good reading.

Everyone has slightly different data, but it helps answer a seeming conflict in the VC markets:

- Massive amounts of funding have flowed into startups … and yet …

- Why doesn’t it seem easier to raise seed funding for many startups?

The answer is what we’ve already seen before, but good to see visually again.

Vast amounts of money went into VC, but:

1/ It’s mostly at the growth stage; and

2/ Even before the growth stage, it’s mostly going into winners.

So net net:

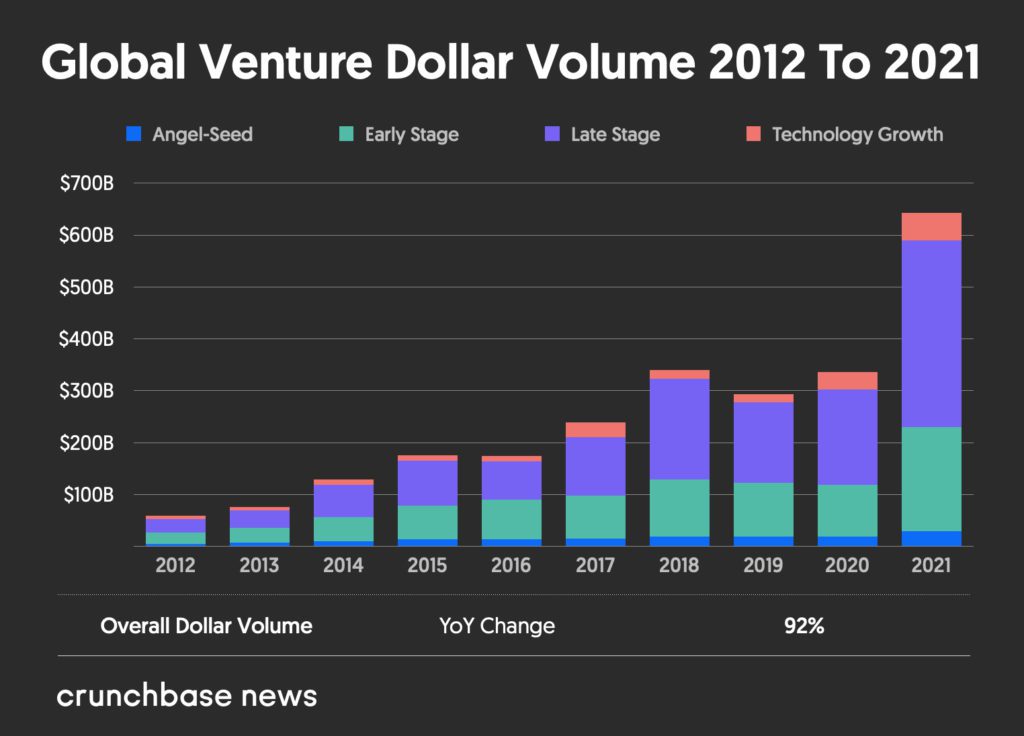

- Global VC investment doubled in 2021 from 2020, from $335B to $643B; and

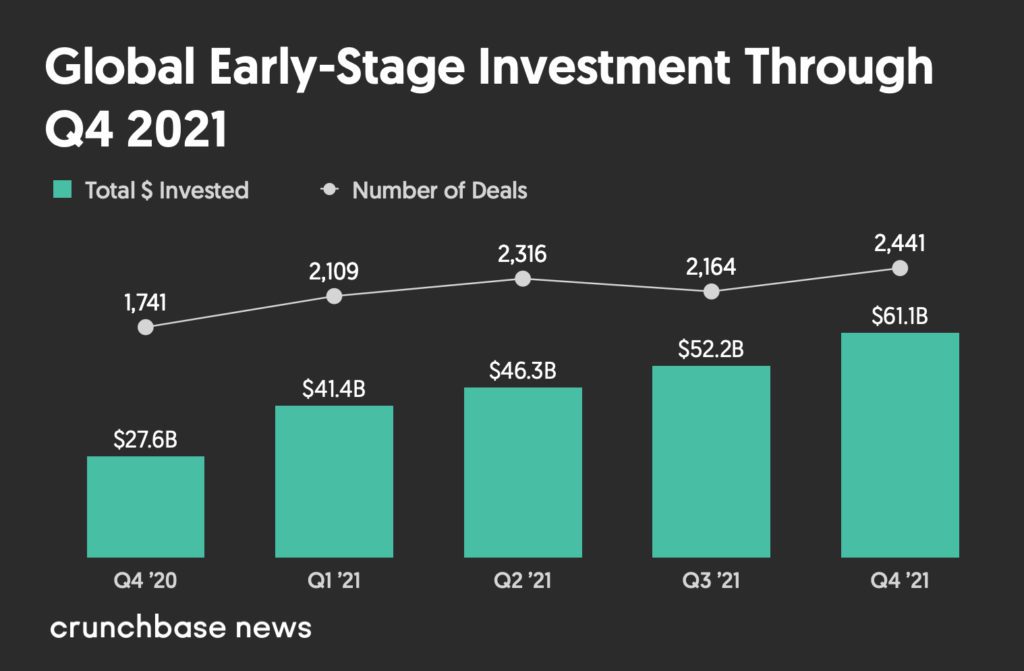

- Overall Series A and earlier-stage deals doubled to $200B from $101B; but

- In number, early-stage deals only grew 25% from 6,500 to 8,000.

Dollars into venture doubled in 2021, and along with it, the rate of unicorn production, topping 1,000 total unicorns. But all that money, that 100% growth in investment — only went to about 25% more startups.

So most of the money is flowing to the top, proven startups.

This doesn’t really make it any easier for most of us. And that may be what you’re feeling, and why even if you are doing OK or even Pretty Good, you are getting a lot of No’s from investors. The bigger checks especially are going to the proven winners, even at ever-higher valuations. Which makes sense.

Global Venture Funding And Unicorn Creation In 2021 Shattered All Records

The post Crunchbase: Early Stage Investment Doubled in 2021. But The # of Companies Funded Only Went Up 25%. appeared first on SaaStr.