Author: Tyler Durden

Source

After the US took several steps to prevent Chinese companies from acquiring both the latest Nvidia AI chips as well as Europe’s semiconductor titan ASML from sending its advanced chipmaking machines to Beijing (which resulted in a one-time flood of Chinese orders into both ASML and NVDA ahead of the sales ban which the market assumed was a recurring thing and priced out Nvidia revenue growth ridiculous higher compared to where it will end up being), China has retaliated by introducing new guidelines that will mean US chips from Intel and AMD are phased out of government PCs and servers, as Beijing ramps up a campaign to replace foreign technology with homegrown solutions, the FT reported.

This escalation in the chip war between the two superpowers in the form of stricter government procurement guidance also seeks to sideline Microsoft’s Windows operating system and foreign-made database software in favor of domestic options, and runs alongside a parallel localization drive under way in state-owned enterprises.

According to the FT, the latest purchasing rules “represent China’s most significant step yet to build up domestic substitutes for foreign technology and echo moves in the US as tensions increase between the two countries.” In the past year, Washington has imposed sanctions on a growing number of Chinese companies on national security grounds, legislated to encourage more tech to be produced in the US and blocked exports of advanced chips and related tools to China.

Chinese officials have begun following the new PC, laptop and server guidelines this year, after they were unveiled with little fanfare by the finance ministry and the Ministry of Industry and Information Technology (MIIT) on December 26. They order government agencies and party organs above the township level to include criteria requiring “safe and reliable” processors and operating systems when making purchases.

On the same day in December, the state testing agency, China Information Technology Security Evaluation Center, published its first list of “safe and reliable” processors and operating systems, all from Chinese companies.

Among the 18 approved processors were chips from Huawei and state-backed group Phytium. Both are on Washington’s export blacklist. Chinese processor makers are using a mixture of chip architectures including Intel’s x86, Arm and homegrown ones, while operating systems are derived from open-source Linux software.

The standards “are the first nationwide, detailed and clear instructions for the promotion of xinchuang”, said a local government official managing IT system substitution.

Beijing’s procurement revamp is part of a national strategy for technological independence in the military, government and state sectors that has become known as xinchuang or “IT application innovation”. State-owned enterprises were similarly told by their overseer, the State-owned Assets Supervision and Administration Commission, to complete a technology transition to domestic providers by 2027, according to two people briefed on the matter. Since last year, state groups have begun quarterly reporting on their progress in revamping their IT systems, though some foreign technology would be allowed to remain, the people said.

The creeping ban on US-made hardware and software means that US companies in China will be dented, starting with the world’s dominant PC processor makers, Intel and AMD. China was Intel’s largest market last year, providing 27% of its $54bn in sales and 15% of AMD’s $23bn in sales. Microsoft does not break out China sales but president Brad Smith last year told the US Congress that the country provided 1.5% of revenues.

It may be difficult for Intel or AMD ever to make the list of approved processors. To be evaluated, companies must submit their products’ complete R&D documentation and code. The top criteria for evaluation is the level of design, development and production completed within China, according to a notice from the state testing agency.

Then again, like most regulations in China, this one too is meant to be broken. As the FT reveals after speaking with two provincal-level procurement officials, some leeway remained to buy computers with foreign processors and Microsoft Windows. But the transition is certainly in place: Lao Zhangcheng, in charge of purchasing 16 fully Chinese computers for an organization under the Shaoxing city transport bureau, said his colleagues had no choice but to get used to domestic operating systems.

“We are replacing old computers that have foreign chips,” Lao said. “After this purchase, basically everyone in the office will have a domestic computer. The old computers we have left with Windows systems can still be used under certain situations.”

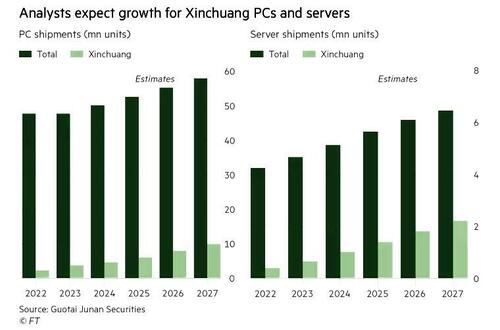

Lin Qingyuan, a chip expert at research group Bernstein, said substitution would progress faster for server processors than for PCs because of the more limited software ecosystem in need of replacement. He expected xinchuang servers to account for 23 per cent of total China server shipments in 2026.

“The purchasing guidance has made the xinchuang policy more actionable for officials,” he added.

Analysts at Zheshang Securities estimate China will need to invest Rmb660bn ($91bn) from 2023 to 2027 to replace the IT infrastructure in government, party organs and eight major industries.

Tyler Durden

Mon, 03/25/2024 – 06:55