Author: D

Source

Diageo plc (DEO) produces, distills, brews, bottles, packages, and distributes spirits, beer, wine, and ready to drink beverages. This international dividend company has increased dividends for 25 years in a row. The company’s peer group includes Brown-Forman (BF.B), Suntory, and Constellation Brands (STZ).

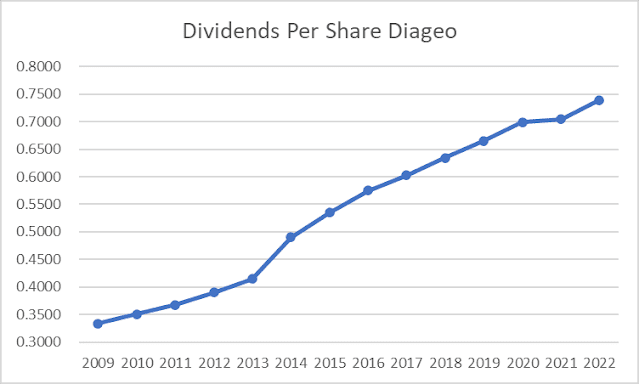

The company’s latest dividend increase was announced in January 2023 when the Board of Directors approved an 5% increase in the interim dividend to 30.83 pence /share. The final dividend had been increased by 5% to 46.82 pence/share in October 2022.

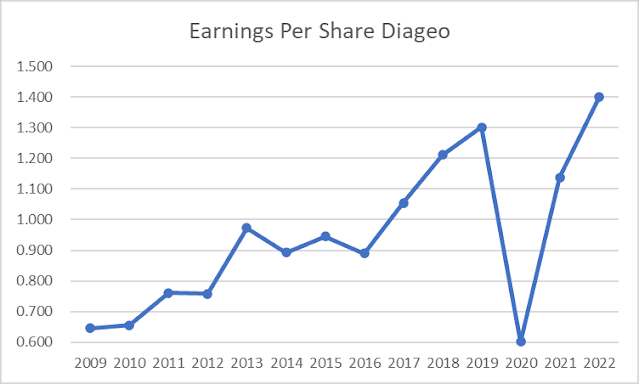

The annual dividend payment has increased by 6.30% per year since 2009, which is in line with the growth in EPS.

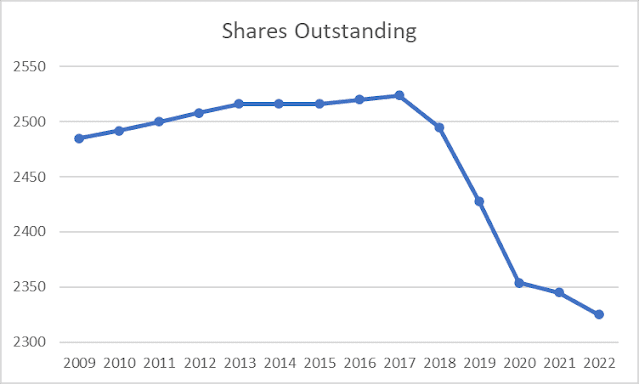

Between 2009 and 2022, the number of shares decreased from 2.485 billion to 2.325 billion.

Currently, the stock is fairly valued, as it trades at a forward P/E of roughly 20.85 and yields 2.24%. I am analyzing the company because I believe it is quality dividend growth stock, which is very good addition to my portfolio. I currently find Diageo to be a much better value than Brown-Forman (BF.B), at 36 times forward earnings and yield of 1.20%.