Author: Jon

Go to Source

There are particular periods in the market where investing appears to be too easy. Things can get crazy when that belief spreads. 2021 was one of those years.

The danger of easy money is that investors become complacent. They become blind to the risks they take. They don’t realize that money made easily, can be just as easily lost.

Of course, anytime too many people believe returns are easy to come by, it’s a good time to return to the basics. Brushing up on sound investing principles, past cycles, and how similar periods ended is always a good idea when investors become risk-seeking en masse.

Warren Buffett once said, “People are habitually guided by the rear-view mirror and, for the most part, by the vistas immediately behind them.” He used it to explain why so many investors were hurt in past market bubbles.

Too often investors rely on recent experience to reinforce decisions. The error lies in setting expectations as if future conditions will exactly mirror the past. Except, markets don’t work that way. Change is constant. Looking backward ignores the craziness ahead.

The benefit of updating the different return quilts each year is seeing how often rearview mirror investing plays out. For instance, frequent double-dip predictions were made several years following the 2008 crash. Worries of a repeat recession, that would drag the market down with it, kept investors out of stocks. Of course, the predictions never came to pass and the U.S. market had one of its best runs ever. The S&P 500 earned a 16% annual return since 2009!

Now that 13 years have passed and the fear has subsided, investors are doing the opposite. They can’t get enough of the stock market. Investing in the rearview mirror would expect more of the same…if you overlook the fact that the conditions today are nothing like 2009.

Every market cycle produces behavioral extremes at the peak and trough that manifest in stock prices. This time is no different.

Investors are more comfortable owning stocks at the height of bull markets than at the depths of a bear. And they repeatedly suffer for it. Investors would be better off if they had a plan for the next bear market during the current bull.

If you haven’t done so already, now is a good time to think about risk management. And it starts with a simple question: Are you comfortable with the consequences if you’re wrong about your portfolio? If the answer is no, it’s time to make adjustments to fit your risk tolerance.

Because the idea that 16% annual returns will drag on for another decade seems silly (market indexes don’t outperform their averages indefinitely). Great runs like this don’t last forever. Be it in two months or two years, that plan will come in handy.

A note before getting to the 2021 numbers. The asset class, sector, international market, and emerging market return quilts, and the historical returns data are up-to-date. Hit the links for each one.

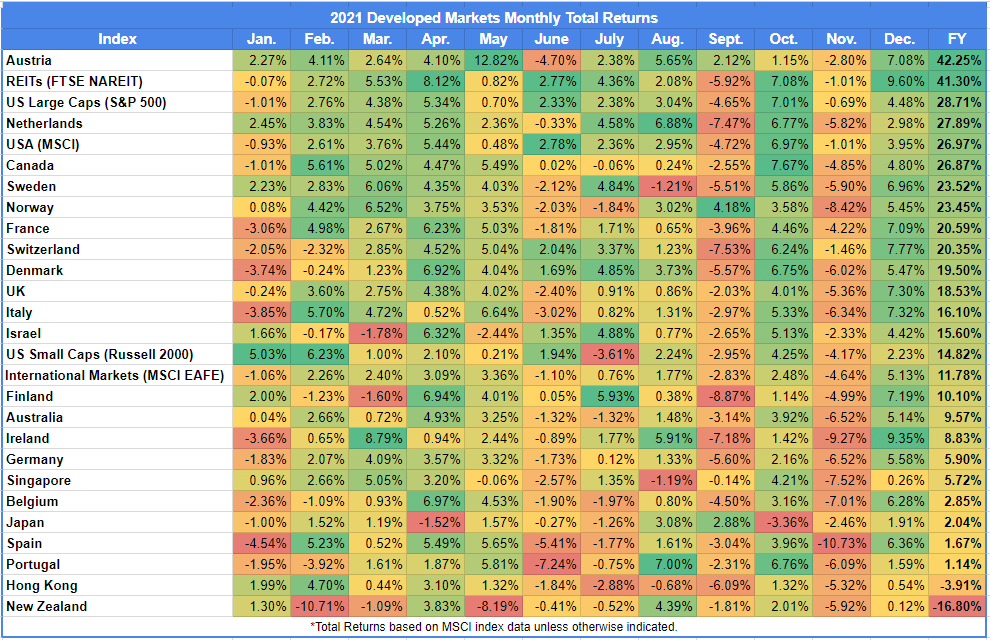

Below you’ll find four tables. The first is a quarterly breakdown of total returns for global stock markets. The next three are monthly breakdowns of developed markets, emerging markets, and U.S. sectors. A few broader lessons stand out:

- The smoothing effect we get from annual returns hides the crazier moves in the market. The quarterly and monthly fluctuations show what investors face when they earn an average return.

- On a similar note, the quarterly and monthly breakdown shows how fruitless market timing can be. Diving in and out of the market this year, in anticipation of a poor quarter or month, likely meant missing out.

- The advantages of diversification should be obvious in the last three tables below. For instance, only four of the eleven U.S. sectors outperformed the S&P 500 this past year. You could try to pick those winners at the start of every year or you can own the S&P 500 and guarantee it. The same concept works more broadly across asset classes. Diversification means you benefit from accidental gains from unexpected places.

And on the lighter side:

- November was an especially rough month. All but 6 countries — all emerging markets — experienced losses that month. That was followed by a December where all but 6 countries — all emerging markets — experienced gains. Interestingly, developed markets moved in unison those last two months of the year.

- Of the major equity asset classes, emerging markets were the sole loser on the year down 2.2%. Of the emerging markets, 6 countries — Brazil, Chile, Colombia, Pakistan, Peru, Philippines, Thailand, Turkey — experienced two losing years in a row. Losing two years in a row is not unheard of. Losing more than three in a row is rare. Historically, only three emerging countries have experienced more than three consecutive losses since MSCI began tracking them.

- The energy sector was the best performing sector of the year. Its 55% return was astounding (most of it came in the first half of the year). But how likely is the energy sector to repeat that performance? It may have a decent year but the top-performing sector rarely keeps that title two years running. In fact, in the past 15 years, it’s only happened once. Again, investors are better off not chasing what’s in the rearview mirror.

- Everyone raves about the U.S.’s (i.e. the S&P 500) performance. Yet, it’s not the best performer over the last 15 years. It’s not even the best performer since 2009. Two countries have topped it. Taiwan and Denmark, in that order, then the U.S. top the list.

- And the worst performer over that same period? Greece has lost 96.4% since 2007!

- There once was a time were the BRICs were touted following the financial crisis. Brazil, Russia, India, and China have had diverging returns since they were combined into that acronym. Since 2007, their performances have diverged. India and China have earned a 166% and 132% total return, respectively, to date. Brazil and Russia, however, faired worse. Both have earned 14.5%! That’s it! A 14.5% total return over the last 15 years. There are risks in trying to pick the best-performing countries over the long run.

Click the tables to enlarge.

Last Call

- Stock Market History, Illuminated – Albert Bridge Capital

- Does Not Compute – M. Housel

- Forecasting Follies – The Better Letter

- 35 Ideas from 2021 – Safal Niveshak

- Why the U.S. Stock Market Has (Recently) Been Exceptional – J. Rekenthaler

- Josh Wolfe: The ‘To the Moon’ Crash Is Coming – Vice

- Michael Mauboussin: How to Read Stock Prices (podcast) – Masters in Business

- The Danger of Leaving Weather Prediction to AI – Wired

- Ninety-Nine Fascinating Finds Revealed in 2021 – Smithsonian

The post 2021: A Year in Returns appeared first on Novel Investor.