Author: Kedar Karkare

Go to Source

The Harvard

Business Review Entrepreneur's Handbook: Everything You Need to Launch

and Grow Your New Business

Free $0.00 Amazon

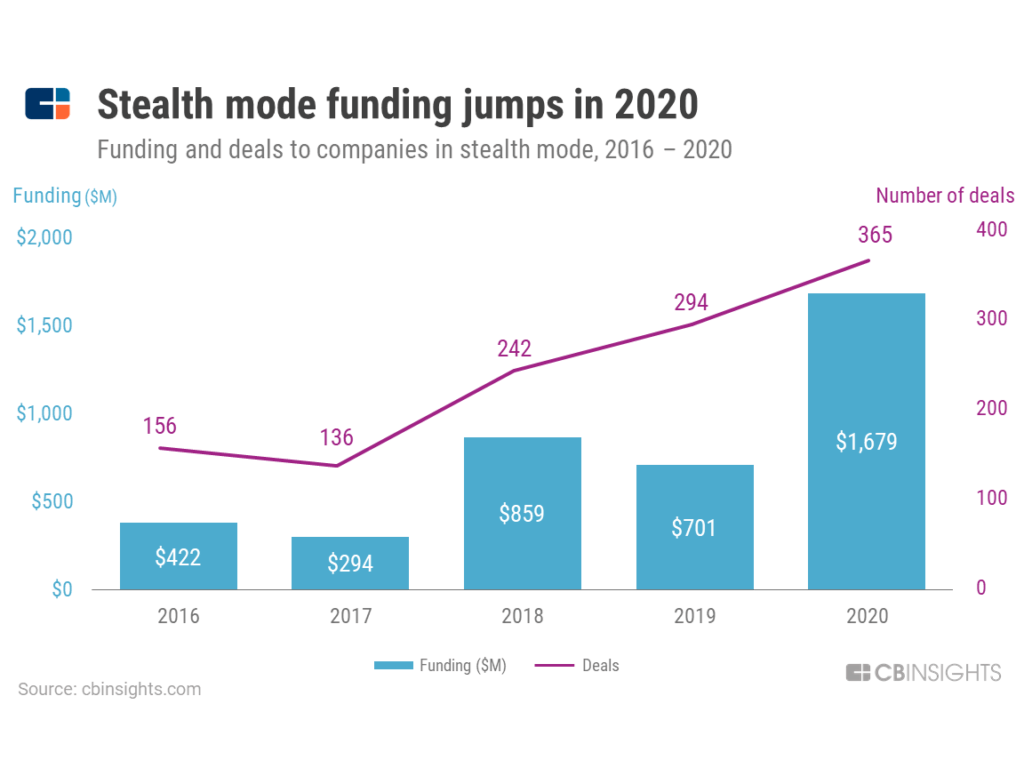

Deals and funding for companies operating in stealth mode – a phase of temporary secrecy regarding the product, brand, or other aspects of the business – have increased in recent years.

WHAT YOU NEED TO KNOW:

- Healthcare and software companies are the stealthiest: In the past 5 years, stealth mode healthcare companies have raised over $1.3B across 350 deals. During the same time, software companies have raised nearly $1.7B across 511 deals.

- NEA and Lightspeed are among the stealthiest VCs: New Enterprise Associates has invested in 8 stealth mode deals, with 3 in the past 2 years. Lightspeed Venture Partners have done 7 stealth mode deals, with 2 in the past year. Other stealthy VCs include Versant Ventures, The Vertical Group, GGV Capital, Khosla Ventures, and Third Rock Ventures.

- United Stealth of America has the most stealth startups: Deals in the United States represented 88% of all stealth mode deals over the past 5 years. California led the way with 282 deals, with New York (102) in a distant second.

WHAT’S NEXT?

- Market uncertainty during Covid-19 may have influenced companies to stay under the radar. As the population is vaccinated and the pandemic wanes, we may see a number of stealth mode companies emerge.

- However, this trend is likely to continue in industries that rely heavily on intellectual property. Startups in the biopharmaceutical industry – which currently has 70 companies in stealth mode – are particularly susceptible to analogous approaches by incumbents and competitors.

The post Stealth Startup Funding Surged In 2020 appeared first on CB Insights Research.