Video by Mitch Investing via YouTube

Source

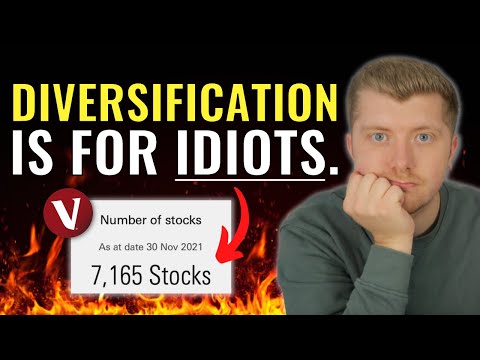

Diversifying Your Investment Portfolio Is For Idiots… Apparently!

00:00 Start Here

Controversial, but is portfolio diversification for IDIOTS?! Well Mark Cuban certainly believes so and even the likes of Warren Buffet and Charlie Munger question whether investors truly know what they’re doing if they’re relying on “wide” or “excessive” diversification. So today we’re going to look how to create an investment portfolio, how many stocks in a portfolio, and i’ll share with you what my own Trading 212 and Vanguard UK portfolio looks like after a tough week in the stock market.

01:23 What Is Diversification?

Diversification is a risk management strategy that is used by investors to mitigate risk and exposure by investing in a collection of asset classes. I’ve ranked 4 different types of diversification from having no diversification whatsoever right the way up to excessive diversification, be sure to let me know where you sit on the spectrum!

04:18 Why You SHOULD NOT Diversify

There are lots of funds out there right now on websites like Vanguard UK which have literally thousands of holdings within them. No we’re not talking about an S&P500 ETF with just 500 stocks, we’re talking about funds with 5,000 – 8,000 different holdings within them. At this point you have to ask yourself the question, whether there is actually any added benefit from having so many more stocks in your investment portfolio? Or are you just getting a collection of all of the good stocks, and all of the bad stocks all in one fund.

06:45 The Optimal Investment Portfolio

The optimal number of stocks to have in an investment portfolio is something that’s widely debated. Some say 10 stocks, others say 30 stocks, some academics even argue 300 stocks is the best investment strategy. I’ll share with you guys my thoughts based on the law of diminishing returns and how adding additional stocks to your portfolio actually becomes less and less beneficial when it comes to “diversification”.

08:45 My Portfolio Performance

So its been a tough week in the stock market, with the stock market selling off, so I thought this would be a good opportunity to actually talk about what a diversified investment portfolio looks like versus a less diversified portfolio. Comparing investments into diversified funds like the Vanguard UK VUSA S&P500 and then individual stock picking in stocks like AAPL, TSLA and PLTR.

11:14 Like & Subscribe!

? Get One Free Share Valued Up To £200! Create A FreeTrade Account Using The Link Below: https://magic.freetrade.io/join/mitchell/e03f87f4

? Get One Free Share Worth Up To £100! Create A Trading 212 Account Using The Link Below:

http://www.trading212.com/invite/FMSw6Qr3

? COINBASE: Get $10 Worth Of BitCoin FREE When Opening An Account With Coinbase & Depositing $100: https://www.coinbase.com/join/shoesm_a3

?Crypto.com: Sign Up and get $25 FREE CRO coin: https://crypto.com/app/5jxerba2ng

? Learn More About Stocks/Cryptocurrency:

Get Two FREE Audio Books https://amzn.to/2D5SLAM

The Intelligent Investor, Benjamin Graham https://amzn.to/2VacWaI

Rich Dad’s Guide to Investing, Robert Kiyosaki https://amzn.to/2uT97MD

Money Master The Game, Tony Robbins https://amzn.to/2T14jwx

The BitCoin Standard https://amzn.to/2QdsQRK

? My YouTube Setup:

Canon M50 https://amzn.to/31IlhnP

Rhode Filmmaker Kit https://amzn.to/31MQNRo (Cheaper alternative below)

Rhode On Camera Mic https://amzn.to/33NgRPc

LED Ring Light https://amzn.to/3kzvrjc

Desk Lights https://amzn.to/3iwXAWk

? Instagram: @mitchinvesting

#StockMarket #InvestmentPortfolio #Diversification

Disclaimer: All ideas presented within this video are that of my own based on my own opinions. Please do not consider any of these videos as financial advice as I am NOT a financial advisor. All financial decisions and choices made are solely your responsibility. The views shared in this video are just for entertainment purposes only.